Real Estate Wholesaling Explained

Real Estate Wholesaling, Explained: A Practical Guide to Contract Assignments, Double‑Closes, and Fast Financing

Wholesaling connects motivated sellers with cash buyers by placing a property under contract and then transferring that contract for a fee — letting investors move deals without long‑term ownership. This guide walks the process step‑by‑step: how assignments and double‑closes work, the financing options that speed time‑sensitive deals, and the practical mechanics most wholesalers rely on — speed, proof of funds, and flexible, equity‑focused underwriting. You’ll get a clear map from lead generation to assignment, the legal checkpoints around assignability, real financing choices (hard money, bridge, and bailout loans), plus how to build a cash‑buyer network that shortens closings. We also cover the documents lenders want, typical approval timelines, sample deal math, and a short FAQ to help you act quickly and confidently in competitive markets.

What Is Real Estate Wholesaling and How Does It Work?

Wholesaling is a short‑cycle investing method that matches motivated sellers with qualified cash buyers by putting a property under contract and then assigning or quickly reselling that contract for a fee. The playbook: secure an exclusive purchase agreement, estimate ARV and repair needs, then market the contract or execute a double close. The advantage is leveraging market knowledge and relationships instead of large capital. That said, wholesaling lowers holding risk while introducing timing and legal risks that demand clean contracts, vetted buyers, and contingency plans. Knowing the steps up front reduces disputes and improves outcomes when title or financing issues surface. The next section breaks the process into clear, sequenced tasks so you can plan timelines and responsibilities.

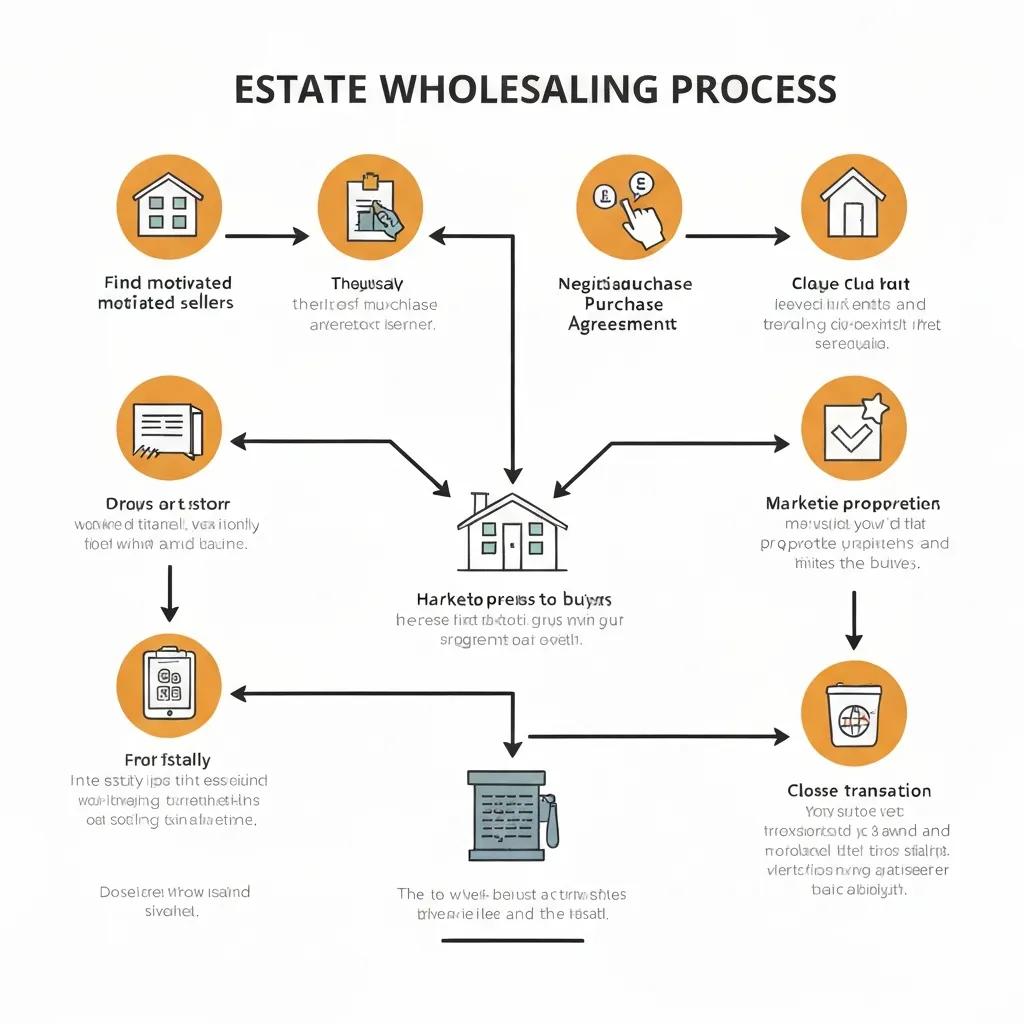

What Are the Key Steps in the Real Estate Wholesaling Process?

Wholesaling follows a straightforward sequence focused on speed and verification. First, source motivated sellers through direct marketing, MLS opportunities, or referrals and perform a fast property evaluation with ARV estimates and a repair scope. Next, secure a purchase agreement that allows assignment or permits a double‑close, then present the contract to a vetted cash‑buyer list while collecting proof of funds. Finally, close either by assigning the contract for an assignment fee or by double‑closing where you temporarily fund purchase and resale; timely title work and escrow coordination are critical. Each step has a short due‑diligence checklist so you can coordinate parties and hit your deadlines.

Who Are the Main Parties Involved in Wholesaling Deals?

Three primary parties make the transaction: the seller (who provides the signed purchase agreement and disclosures), the wholesaler (who secures the contract and markets it), and the end buyer (who completes the purchase with cash or short‑term financing). Supporting players typically include title/escrow companies that run title reports and handle closing, contractors who prepare repair estimates for ARV calculations, and private or hard money lenders who may provide proof of funds or short‑term bridge capital. Clear role definitions prevent surprises at closing and help you choose whether to assign the contract or use temporary funding.

How Do Assignment Contracts Work in Real Estate Wholesaling?

An assignment transfers a buyer’s rights in an existing purchase agreement to a third party, letting the original buyer (the wholesaler) collect an assignment fee while the end buyer completes the purchase. Practically, you add an assignment addendum or separate assignment agreement to the original contract and confirm the contract allows assignment. The key benefit: the wholesaler doesn’t have to fund the purchase but remains in contractual control until assignment. Assignment language should clearly state fee payment, inspection contingencies, and closing responsibilities to limit disputes. The next section walks the assignment process step‑by‑step and compares it to double‑closing so you can select the appropriate structure for each deal.

What Is an Assignment of Contract in Real Estate?

An assignment of contract is a legal transfer of the original buyer’s contractual position to a third party in exchange for an assignment fee, moving rights and obligations under the purchase agreement. Key steps: confirm the contract can be assigned, add an assignment addendum or execute a separate assignment agreement, secure an end buyer with proof of funds, and give escrow clear instructions so the assignment fee is paid at closing. Title and escrow cooperation is often required to ensure funds flow correctly and any seller‑consent rules are followed. Proper documentation and buyer qualification reduce legal friction and typically speed closings compared with buying and reselling the property outright.

What Are the Legal Considerations and State Regulations for Wholesaling?

Wholesaling is governed by state rules that can affect assignability and whether brokering activity requires a license. Important considerations include disclosure duties to sellers and buyers, explicit contract language about assignment rights, and compliance with state rules that may restrict undisclosed profit sharing or require a licensed broker when acting as an intermediary. To stay compliant, use clear assignment clauses, keep written records of buyer qualification and proof of funds, and consult a real estate attorney when local statutes or precedent suggest limits. Staying proactive about regulatory differences prevents delays and helps you choose assignment or double‑close strategies that reduce legal risk.

How Can Hard Money Loans Support Real Estate Wholesaling Deals?

Hard money and short‑term private financing support wholesalers by supplying quick capital, credible proof of funds, and underwriting that pivots on property value rather than borrower credit — making them well‑suited for time‑sensitive acquisitions and double‑closes. Underwriting focuses on asset appraisal, repair budgets, and LTV/ARV math, so approvals are typically faster than traditional bank loans. For wholesalers, the practical benefits are speed, lighter documentation requirements, and access to funds for bailouts or simultaneous buy‑and‑resell closings. The table below summarizes common loan types and how wholesalers use them to execute deals efficiently.

| Loan Program | Typical Underwriting Focus | Common Wholesaling Use-Case |

|---|---|---|

| Hard Money Purchase Loan | LTV and property equity | Rapid acquisition and proof of funds for assignments or double‑closes |

| Fix & Flip Loan | ARV and rehab budget | Short‑term purchase plus rehab when converting a wholesale opportunity into a flip |

| Bridge Loan | Outstanding liens and exit plan | Short‑term bridge between purchase and resale when timing is tight |

| Foreclosure Bailout Loan | Speed and foreclosure timeline | Stop a foreclosure and buy time to market or assign the contract |

| DSCR / P&L Based Approval | Rental cash flow or business income | Transitional financing when turning a wholesale prospect into a rental |

What Are Hard Money Loans and Why Are They Ideal for Wholesalers?

Hard money loans are short‑term, asset‑backed loans that underwrite against property value, LTV, and ARV instead of full credit profiles or traditional income documentation. They’re valuable to wholesalers because they move fast: property‑driven diligence and appraisals typically complete more quickly than conventional mortgages, enabling closings in days or weeks. Hard money also provides solid proof of funds that strengthens offers on distressed properties. Since the property is the primary collateral, lenders can often structure short‑term purchase or bridge loans that line up with assignment timelines and double‑close strategies.

Which Fidelity Funding Loan Programs Benefit Wholesalers Most?

Fidelity Funding provides short‑term financing options tailored to common wholesaling needs, prioritizing property equity over borrower credit and offering fast funding when timing matters. Typical fits include Hard Money Purchase Loans for quick acquisitions and proof‑of‑funds, Fix & Flip Loans for rehab‑plus‑resale scenarios or double closes, Bridge Loans to bridge timing gaps between purchase and resale, and Foreclosure Bailout Loans for urgent distressed cases. Product details include interest rates starting at approximately 6.99 percent, loan terms from 12 to 60 months, loan amounts from $50,000 upward, LTV ratios up to 70 percent (75 percent case‑by‑case), ARV considerations up to 85–90 percent, and in select cases 100 percent rehab funding; funding speed is often within 5 to 7 days. These features make Fidelity Funding a practical partner when wholesalers need fast, equity‑first solutions for time‑sensitive deals.

What Are the Requirements and Approval Steps for Hard Money Loans in Wholesaling?

Hard money approval for wholesale transactions focuses on property documents, a repair scope, and a clear exit strategy rather than exhaustive personal financial history. The approval path usually follows application, appraisal/valuation, title review, underwriting focused on LTV/ARV, and closing — a sequence designed for speed when documents are complete. Below is a pragmatic checklist of common documents and property criteria lenders request, plus typical delivery timelines so you can prepare in advance.

| Document / Criterion | Why It Matters | Typical Time to Provide |

|---|---|---|

| Purchase agreement (with assignment clause if used) | Establishes terms and enforceability of the transaction | 1–3 days |

| Property photos and repair estimates | Supports ARV and rehab budgeting for underwriting | 1–5 days |

| Preliminary title report / lien search | Identifies encumbrances that affect closing | 2–7 days |

| Proof of funds or buyer qualification | Validates end‑buyer ability to close or lender backup plan | Same day–3 days |

| ID and entity documents (if applicable) | Verifies borrower identity and legal standing | 1–3 days |

What Documents and Property Criteria Are Needed for Approval?

Lenders look for items that prove clear collateral value and an executable exit: an executed purchase agreement, recent property photos, a contractor repair scope, and a title search to reveal liens or judgments. Repair estimates and contractor bids let underwriters model ARV and determine whether rehab reserves or full rehab funding are needed — these items directly affect allowable LTV and approval thresholds. For assignments, lenders commonly request the purchase contract with explicit assignment language or a documented double‑close plan, plus proof of buyer qualification or proof of funds if the end buyer will finance the resale. Preparing these materials before you apply shortens underwriting and reduces conditions at closing.

How Fast Can Wholesalers Expect Loan Funding and Closing?

When documents are complete and title is clear, property‑focused hard money lenders often fund on a compressed timeline — many rapid programs close in about 5–7 days, with more complex files taking 7–14 days. Things that speed funding include quick repair estimates, an early title order, and immediate proof of funds from end buyers. Delays usually stem from undisclosed liens, complicated title issues, or incomplete repair budgets. To meet tight windows, pre‑qualify buyers, order title early, and have contractors ready; these steps typically cut conditional rounds and accelerate closing.

How Do Wholesalers Build a Successful Cash Buyer Network?

A reliable cash buyer network is the backbone of consistent wholesaling — it shortens marketing cycles, raises the chance of assignment, and supports higher fees by creating buyer competition. Building that network takes a mix of outreach channels, quick qualification criteria, and regular list maintenance so contacts stay active and verified. Below are tactical strategies you can use to find motivated cash buyers and qualify them fast to reduce wasted marketing time.

- Attend local investor meetups and REIA events to meet active flippers and landlords and collect contact details.

- Use online marketplaces and social platforms to promote deals and capture buyer interest quickly.

- Partner with title companies, auction houses, and real estate agents who refer active cash buyers and help verify proof of funds.

What Strategies Help Find and Connect with Motivated Cash Buyers?

Combine in‑person networking with targeted digital outreach and ads that highlight property type and expected margins. Ask brief qualification questions to confirm purchase capacity and intent — for example, whether the buyer uses cash, hard money, or private financing, their preferred property types, and typical closing timelines. Segment your buyer list (flippers, landlords, rehabbers) and use concise email templates and SMS alerts to notify matched buyers immediately when new inventory arrives. Fast qualification saves time and raises your closing predictability.

How Does a Strong Buyer’s List Impact Wholesaling Profits?

A well‑maintained buyer list shortens marketing cycles and increases leverage when setting assignment fees because multiple qualified buyers create competition that supports higher fees. Faster assignments lower the risk of contract expiration or market shifts, preserving net margins after financing and closing costs. Segmenting buyers by purchasing capacity and property preference enables targeted outreach and higher conversion per deal, which scales into greater deal velocity and steadier revenue. With an efficient buyer pipeline, you can focus on sourcing and negotiating contracts instead of long buyer searches.

What Are Common Wholesaling Challenges and How Does Financing Help Overcome Them?

Wholesalers face hurdles like seller urgency, title problems, a small buyer pool, and the need to show proof of funds. Targeted financing options reduce these frictions by providing speed, verifiable funds, and short‑term capital to bridge timing gaps. Each challenge maps to a financing response: bailout loans for imminent foreclosures, bridge loans for timing gaps, and purchase loans for double‑closes when assignment isn’t practical. Identifying the right product and preparing documents in advance turns these challenges into manageable steps. The following section explains how credit, property eligibility, and foreclosure timelines typically affect wholesale executions and which mitigation tactics work best.

How Do Credit, Property Eligibility, and Foreclosure Timelines Affect Wholesaling?

Asset‑backed lenders rarely let personal credit be the deciding factor because approvals hinge on property equity and ARV; still, a documented exit plan and clear title matter more when borrower credit is weak. Property eligibility problems — major structural issues, environmental concerns, or unpaid taxes — can block approvals or lower allowable LTV, so early inspections and title reviews are essential. In foreclosure cases, timing is critical: lenders offering foreclosure bailout or bridge solutions that prioritize speed and collateral value can stop sales and create time to market the property or assign the contract. Property‑focused underwriting is the typical workaround for these common barriers.

How Do Hard Money Loans Provide Solutions for Time-Sensitive Deals?

Hard money and bridge products are designed to close faster than conventional financing because underwriters evaluate collateral value, ARV, and a clear exit rather than full traditional documentation, allowing funding within days when title and repair estimates are ready. For foreclosure bailouts, lenders prioritize speed and can supply short‑term capital to clear immediate encumbrances, preventing trustee sales and allowing time to resell or rehab. Proof‑of‑funds letters from a lender strengthen offers and help wholesalers secure exclusive contracts that can later be assigned or double‑closed. These product features directly address wholesalers’ most urgent problems: timing and certainty.

What Are Real-World Examples of Successful Wholesaling Using Hard Money Loans?

Real examples show how financing choices shape outcomes: a quick purchase loan can enable a double‑close on a motivated seller; a bailout loan can stop a foreclosure and preserve assignment value; and a fix‑and‑flip loan with rehab funding can turn a wholesale lead into a profitable flip. Each scenario depends on fast valuation, a clear exit, and lender cooperation on timing and funds flow — the levers that convert time‑sensitive leads into closed deals. The table below gives simplified deal math ranges that mirror typical financing costs and timelines so wholesalers can estimate net margins.

| Deal Type | Financing Cost / Timeline | Typical LTV or ARV Guidance |

|---|---|---|

| Quick Purchase for Double-Close | Interest + origination for 1–2 weeks; funding in 5–7 days | LTV up to 70% on purchase; 75% case-by-case |

| Foreclosure Bailout | Short-term loan to stop sale; fast funding within 5–7 days | Emphasis on equity and speed rather than full credit |

| Fix & Flip Conversion | Rehab funding included; term 12–60 months as needed | ARV-based underwriting up to 85–90% with rehab reserves |

How Did Investors Use Fidelity Funding Loans to Close Deals Quickly?

Investors have relied on rapid hard money purchase loans and bridge products to secure properties under contract and either double‑close or assign with minimal delay. Fidelity Funding’s property‑first underwriting and accelerated review cadence support these outcomes by providing proof of funds and funding often within a 5–7 day window when documents and title are clear. In bailout cases, lenders have focused on clearing immediate cash needs to stop foreclosure, then allowed time to market or resell to a cash buyer. These examples show how choosing the right product for transaction urgency is the decisive factor in closing time‑sensitive wholesale deals.

What Profit Margins Can Wholesalers Expect After Financing Costs?

Net profit depends on the assignment fee less financing costs, origination charges, and closing expenses. A simple planning formula is: assignment fee − financing cost − closing/admin fees = net profit. Typical financing items include origination fees and short‑term interest accrual; conservative modeling uses reasonable origination ranges and short timelines to avoid margin erosion. If assignment fees are set competitively and financing is used only for the shortest necessary window, wholesalers can retain healthy margins after funding costs. The best practice is to model several timelines and scenarios so assignment fees reliably cover financing and transactional expenses.

Frequently Asked Questions

What are the risks associated with real estate wholesaling?

Wholesaling carries legal and timing risks. Contracts must be clear and compliant with state rules to avoid disputes. The model also depends on motivated sellers and responsive cash buyers, so market shifts or buyer dropouts can create problems. Timing matters — delays can erase profit or cause missed closings. The right mix of solid contracts, buyer qualification, and contingency plans helps mitigate these risks.

How can wholesalers effectively market their contracts to cash buyers?

Use both online and offline channels: social media, investment forums, dedicated deal pages, plus local meetups and networking events. Present concise, credible property information — ARV estimates, repair scopes, photos — to build trust quickly. Fast, targeted outreach and clear deal sheets help interested buyers evaluate offers and move to close sooner.

What should wholesalers include in their buyer qualification process?

Verify proof of funds, ask how the buyer will finance purchases (cash, hard money, private funds), and confirm their experience and timelines. Ask about preferred property types and typical turnaround times. A short qualification script and periodic re‑verification of funds keep your buyer list accurate and reliable.

How do market conditions affect wholesaling strategies?

Market dynamics shape both supply and demand. In a seller’s market, prices rise and spreads tighten, making profitable contracts harder to find. In a buyer’s market, distressed inventory may increase while buyer demand softens. Adapt by shifting marketing tactics, adjusting target property types, or tightening buyer qualification to match current conditions.

What role does negotiation play in wholesaling deals?

Negotiation is central: it sets the purchase price and the assignment fee. Strong negotiation secures better spreads and larger fees. Clear terms with cash buyers speed closings and reduce disputes. Listening to seller and buyer motivations often uncovers creative solutions that improve deal economics.

What are the best practices for maintaining a cash buyer list?

Keep the list segmented by buyer type and preferences, verify proof of funds regularly, and communicate new opportunities consistently. Use a CRM to track interactions and automate alerts. Regular outreach — newsletters, market updates, and targeted deal alerts — keeps buyers engaged and responsive.

How can wholesalers leverage technology to enhance their operations?

CRMs streamline lead and buyer management and automate follow‑ups. Online marketing tools increase deal visibility. Data and analytics help you identify hot neighborhoods and price points. Together, these tools speed deal flow and improve organization across sourcing, qualification, and disposition.

Is Real Estate Wholesaling Legal and Do You Need a License?

Wholesaling is generally legal in many states but subject to local rules that distinguish assignment activity from broker‑type behavior, which can trigger licensing requirements in some jurisdictions. Best practices: disclose assignment fees to sellers and buyers, include explicit assignability language in contracts, and avoid representing broker services without a license. If you’re unsure about local thresholds, consult a real estate attorney or your state regulator. Clear documentation and transparent communication are your best safeguards.

How Do Wholesalers Make Money and What Are Typical Assignment Fees?

Wholesalers earn an assignment fee for sourcing and securing the contract. Fees vary by market and deal complexity and can be a fixed dollar amount or a percentage of the spread between the contracted purchase price and the buyer’s offer. Factors that affect fee size include time sensitivity, uniqueness of the deal, and buyer competition. Delivering clean, well‑documented deals and maintaining a strong buyer list increases your ability to command higher fees. Always model fees against financing and closing costs to confirm net targets are met.

If you’re ready to submit deals or explore short‑term funding with a property‑first lender: gather your purchase agreement, repair estimates, photos, and preliminary title information. Fidelity Funding focuses on property equity over credit and can provide fast approvals and funding when documents are complete. Prepare the checklist above and have an exit plan ready — whether assigning the contract or executing a double close — to maximize your chances of quick approval and execution.

Conclusion

Wholesaling lets you connect motivated sellers with cash buyers and close transactions quickly without heavy capital outlay. By mastering the core process, understanding legal requirements, and choosing the right financing, you can reduce risk and protect margins. If you want faster, property‑first financing to close time‑sensitive deals, explore our short‑term solutions designed for wholesalers. Start building a repeatable, efficient wholesaling strategy today.