Best Hard Money Lenders in California: A Practical Guide to Finding the Right Hard Money Partner

Hard money lending is private, asset-backed financing that leans on property equity and collateral instead of traditional credit checks. For many California investors it’s the fastest route to short-term capital. This guide breaks down what hard money loans are, when they make sense, and how to pick the lender that fits your deal. You’ll find clear comparisons to conventional loans, a program-by-program overview of common hard money products, a practical approval checklist with typical timelines, and verification points for vetting lenders. If you’re racing a deadline—an aggressive purchase offer, a quick rehab start, or a foreclosure rescue—use these plain-language tools and checklists to match the right product to your exit strategy and understand how equity-first underwriting and in-house decisioning affect deal economics.

What Is a Hard Money Loan and Why Should California Investors Consider It?

A hard money loan is short-term financing secured primarily by real estate value rather than by borrower credit. Lenders focus on the property’s equity and a clear exit plan, which lets qualified borrowers close far faster than with conventional mortgages. California investors typically choose hard money when speed is critical, when a property needs work before it can qualify for a traditional loan, or when personal credit slows down conventional approvals. The trade-offs are higher rates and shorter terms, balanced by the ability to capture time-sensitive opportunities—competitive acquisitions, fast rehabs, or foreclosure interventions. Knowing these basics helps you line up the right program for your exit plan and estimate the cost-versus-reward on any deal.

Next: how hard money underwriting and timelines actually differ from traditional financing.

How Do Hard Money Loans Differ from Traditional Real Estate Financing?

Hard money underwriters prioritize collateral and exit strategy—ARV and equity matter most—while traditional lenders emphasize credit scores, full income documentation, and automated appraisal pipelines. Because of that focus, hard money can approve deals that stall with conventional lenders. Funding speed is another big difference: hard money can close in days to a couple of weeks; conventional loans often take several weeks to months because of stricter documentation, processor queues, and secondary-market rules. In practice, hard money functions as short-term bridge financing: higher rates and fees in exchange for flexible, collateral-driven underwriting and faster execution.

Those distinctions point to the borrower types that get the most value from fast, asset-based financing.

Who Benefits Most from Hard Money Loans in California?

Hard money fits several borrower profiles: fix-and-flip investors who need rapid acquisition and rehab capital, landlords seeking short bridge loans for tenant turnover or refinance, and owners facing imminent foreclosure who require urgent liquidity. It also serves buyers of properties that fail conventional underwriting—severely distressed houses, title complications, or unconventional assets—where solid equity can still secure a loan. In every case, the exit strategy (sale, refinance to a conventional loan, or conversion to a rental) is the primary underwriting focus. Identifying which scenario matches your situation helps you choose among purchase loans, rehab lines, bailouts, commercial or DSCR products, and frames negotiation points like LTV and term length.

With borrower profiles mapped, the next section lists typical loan programs and how they operate in practice.

What Types of Hard Money Loans Does Fidelity Funding Offer?

Hard money products address different use cases—quick purchases, fix-and-flip projects, bridge loans, foreclosure bailouts, and commercial lending—each with its own LTV, term, and funding expectations. Below is a scannable program comparison to help you match need to product.

The table summarizes typical program attributes—target borrower and expected funding timeframe—so you can quickly see which product aligns with your timeline and trade plan.

| Loan Program | Typical LTV Range | Typical Term (months) | Interest Rate Range | Typical Loan Amounts | Target Borrower | Funding Time |

|---|---|---|---|---|---|---|

| Purchase Loan | 60–75% | 6–12 | Higher than conventional | $50,000–$5,000,000+ | Investors needing fast close | 5–14 days |

| Fix & Flip | 65–80% (ARV basis) | 6–12 | Short-term rehab rates | $50,000–$10,000,000 | Rehab investors | 5–14 days |

| Commercial Hard Money | 50–75% | 12–36 | Commercial short-term rates | $250,000–$50,000,000 | Small commercial investors | 7–21 days |

| Foreclosure Bailout | Varies, equity-based | 1–6 | Premium short-term rates | $50,000–$5,000,000 | Owners facing foreclosure | 3–10 days |

| DSCR / P&L Based | LTV based on income metrics | 12–36 | Debt-service-focused rates | $100,000–$25,000,000 | Investors with rental income | 7–21 days |

The table highlights trade-offs between leverage and speed: higher LTV increases risk and cost, while faster funding reduces opportunity risk. Fidelity Funding is a private hard money lender serving California that emphasizes rapid closings—often within 5–7 days for qualifying deals—uses in-house underwriting to speed decisions, and offers loan sizes from $50,000 up to $50,000,000 with selective high-LTV programs up to 80–90% on certain assets. These program details show how an equity-first private lender can accelerate deal timelines without relying on external capital markets.

Next, we walk through how purchase, rehab, and commercial products work in real transactions.

How Do Purchase, Fix and Flip, and Commercial Loans Work?

Purchase loans let you secure property quickly by relying on collateral-focused underwriting and simplified income checks. Fix-and-flip loans combine acquisition and rehab funding or provide rehab draws tied to inspections and contractor budgets—underwriting centers on projected after-repair value and the sale exit. Commercial hard money loans are larger, often use both collateral and DSCR analysis for income-producing properties, and include commercial title and environmental reviews. Exit routes vary: purchase loans usually refinance or resell, flips repay from sale proceeds, and commercial loans convert to longer-term financing or operate on stabilized cash flow. Matching LTV and term to your exit plan and modeling carrying costs are essential to protect profit margins.

That leads into bridge loans, foreclosure bailouts, and income-based (DSCR/P&L) paths that solve other investor needs.

What Are Bridge Loans, Foreclosure Bailouts, and DSCR Loan Options?

Bridge loans cover short timing gaps—like buying a replacement while you sell an existing property—and typically run for a few months with higher rates for the short term. Foreclosure bailouts prioritize speed to halt trustee sales, focusing on lien payoffs and clean title paths; documentation is streamlined to verify equity and payoff figures. DSCR and P&L loans underwrite against property cash flow or business income when personal income documentation is limited; lenders use debt-service coverage calculations and may accept profit-and-loss statements or lease schedules. Use DSCR for rental portfolios and P&L paths for operator-driven businesses that prefer income-based underwriting over FICO-focused reviews. These specialized solutions bridge timing gaps and fit nontraditional income profiles.

With product options covered, let’s explain how approval and funding timelines usually unfold, and where in-house underwriting speeds things up.

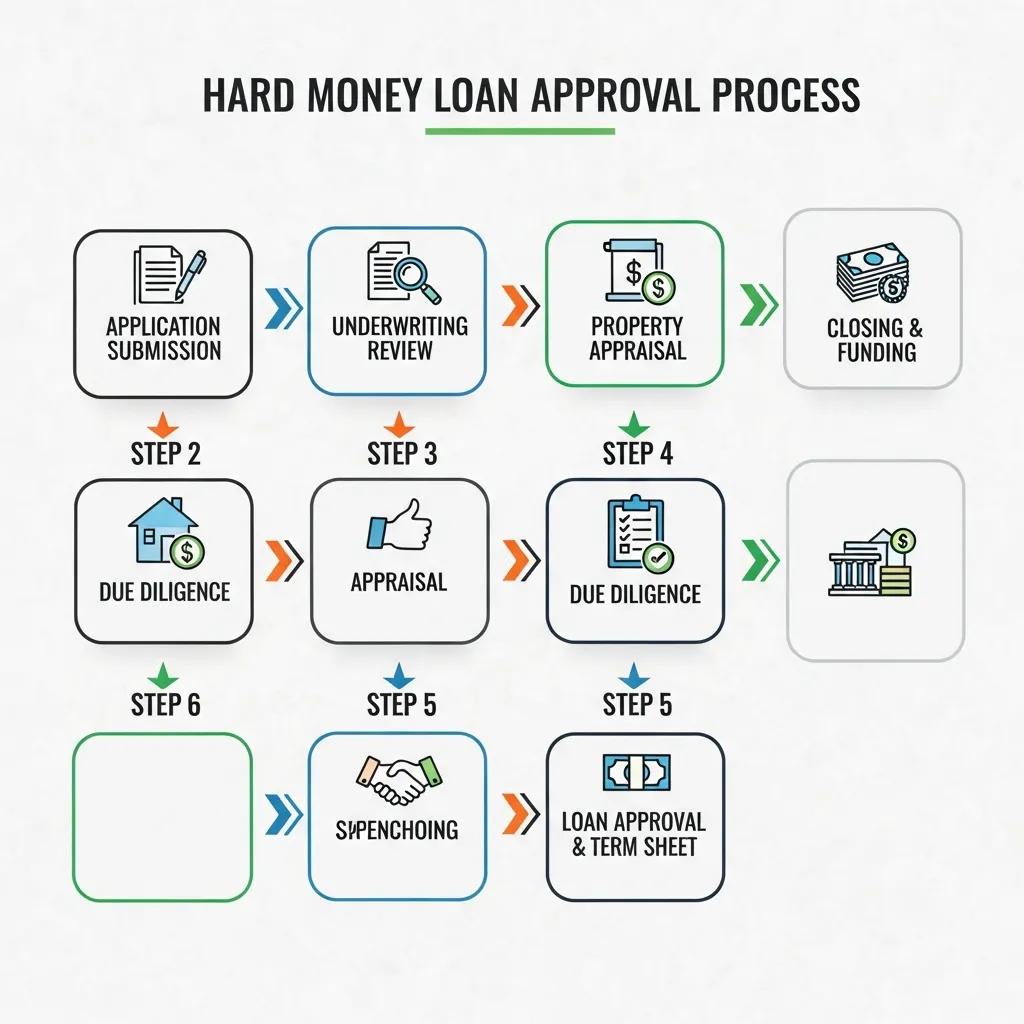

How Does the Hard Money Loan Approval Process Work?

A transparent approval process follows predictable steps: initial submission, underwriting and condition review, title and document preparation, closing, and funding. Each phase has typical timeframes and required documents that determine speed. Lenders with in-house underwriting compress decision windows by removing external approvals and streamlining conditional sign-offs—so equity-focused private lenders can move from application to funding in a matter of days. The table below shows who’s involved, expected durations, and the documents that keep each stage moving so you can plan a realistic timeline for time-sensitive deals.

| Process Step | Who/What is Involved | Typical Timeframe | Required Documents |

|---|---|---|---|

| Initial Application | Borrower submits deal package | 24–72 hours | Basic deal summary, property address, photos |

| Underwriting Review | In-house underwriter analyzes collateral | 1–5 days | Appraisal/market comps, repair estimate, exit plan |

| Conditional Approval & Docs | Title search, loan docs prepared | 2–7 days | ID, title work, insurance, contractor bids |

| Closing & Funding | Escrow/closing agent completes transaction | 1–3 days | Signed loan docs, payoff instructions, final title |

Common bottlenecks include title issues, incomplete repair scopes, and unclear exit strategies. Submitting accurate comps and contractor estimates shortens underwriting questions. Fidelity Funding’s in-house process and stated fast funding windows (commonly 5–7 days on qualifying submissions) demonstrate the operational advantage of internal decision-making for urgent deals. To hit fast timelines, submit a complete package and be prepared to execute title and closing forms quickly.

Follow the checklist below to prepare and avoid avoidable delays.

What Steps Are Involved from Application to Funding?

The typical path from application to funded loan follows these steps, each with a clear owner and expected duration:

- Initial deal submission and preliminary eligibility check (borrower/lender, 24–72 hours).

- In-house underwriting review, comps and repair estimate verification, and conditional approval (underwriter, 1–5 days).

- Preparation of loan documents, title work, and final borrower underwriting (closing team, 2–7 days).

- Closing and funding via escrow with final signatures and lien recording (escrow/closing, 1–3 days).

Tasks often overlap when borrowers provide documents promptly; overlap shortens total time to close. Common delays stem from incomplete repair bids and slow title clearance, so plan for those when setting a closing goal. When speed matters, prioritize quick document delivery and a realistic exit plan to align underwriting and funding windows.

Which Documents and Criteria Are Required for Approval?

Prepare this concise documents checklist to accelerate review: verified ID, current property photos, title summary, contractor repair estimates and draw schedule, bank statements or P&L (for income-based approvals), lease rolls for rentals, and a clear exit strategy showing planned refinance or resale.

Lenders prioritize proof of equity (appraisal or comps supporting ARV) and a credible rehab scope for flips; DSCR or P&L loans require rent rolls or profit-and-loss statements to calculate coverage ratios. Clear contractor bids and an organized repair draw schedule reduce scope disputes and underwriting questions, moving you faster from conditional approval to funding. Being document-ready materially shortens lender review time.

Once you’re document-ready, the next decision is choosing which lender attributes to evaluate when selecting a hard money partner.

What Key Factors Should You Evaluate When Choosing a Hard Money Lender?

Choose a lender using objective criteria you can verify: reputation, transparent fees, underwriting flexibility, funding speed, and local market expertise. These elements matter as much as price when you’re comparing offers for time-sensitive deals.

The table below turns subjective factors into practical questions you can ask a prospective lender and checkpoints you can verify against your deal requirements. Use these to weigh trade-offs between rate, speed, and structure across providers.

| Factor | What to Look For | Example Questions to Ask Lender |

|---|---|---|

| Reputation | Local track record, references, case outcomes | “Can you share recent example deals in California with similar scope?” |

| Transparency | Clear fee schedule, written terms, no hidden charges | “What are all fees and is there a prepayment penalty?” |

| Speed & Operations | In-house underwriting, average funding time | “What is your typical approval and funding timeframe?” |

| Underwriting Flexibility | Equity-first decisions, DSCR/P&L options | “Do you accept P&L or DSCR instead of full personal income docs?” |

These checks let you compare proposals not just on headline rates but on execution risk—critical for deals where timing matters. Fidelity Funding’s stated strengths—fast funding (commonly 5–7 days for qualifying deals), in-house underwriting, no prepayment penalties, and selective high-LTV programs—are examples of operational choices that change real-world execution and borrower cost. Use the sample questions to validate a lender’s process on comparable transactions.

How Do Reputation, Transparency, and Experience Impact Your Choice?

Reputation and experience reduce surprises: lenders with a local track record understand comps, pricing, and close risks in specific California submarkets. Clear fee disclosure prevents last-minute cost shocks and makes profit modeling accurate. Operational experience—especially established title and escrow relationships—cuts closing risk. Verify these factors by asking for references, sample term sheets, and clarity on which functions are in-house versus outsourced. Prioritizing these qualitative attributes aligns lender incentives with your exit plan and lowers execution risk.

Next, quantify the loan terms and fees you should compare to estimate true cost.

What Loan Terms, Interest Rates, and Fees Should You Compare?

Compare interest rate, points, origination fees, and prepayment terms to understand the real cost. Small differences in points or an extra month of interest can materially change net profit on a flip or refinance. Factor in LTV trade-offs: higher leverage boosts buying power but raises carrying costs and liquidation risk if ARV is missed. Run simple math: total carrying cost (interest + points + fees) versus expected resale gain or refinance proceeds to determine net yield. Watch for appraisal, inspection, or lender-placed insurance fees, and confirm prepayment language—Fidelity Funding states no prepayment penalties, which preserves exit flexibility. Quantifying each component lets you make apples-to-apples comparisons between lenders.

With pricing clear, the next section outlines the core benefits that make hard money the right tool in many investor toolkits.

What Are the Benefits of Hard Money Loans for Real Estate Investors and Property Owners?

Hard money delivers three practical advantages: speed to close, flexible underwriting for nonstandard assets or borrowers, and the ability to leverage equity to execute opportunistic strategies. Speed lowers opportunity cost and improves win rates on competitive offers. Equity-first underwriting accepts properties and borrowers that conventional lenders often decline. Using property equity lets investors amplify returns on flips and bridge timing gaps between transactions—provided higher rates and fees are included in deal modeling. When matched with a clear exit strategy and conservative assumptions, hard money is a tactical financing tool.

These benefits are most visible in time-sensitive situations; the next section shows how timelines and underwriting flexibility work in practice.

How Does Fast Funding and Flexible Underwriting Help Time-Sensitive Deals?

Fast funding turns opportunities into closed deals where conventional mortgages would miss the window. For example, a competitive purchase with a short close can be secured with a hard money purchase loan and later refinanced. Flexible underwriting lets investors acquire and renovate properties that wouldn’t meet conventional condition standards until after rehab. For foreclosure rescues, a quick bailout can stop a trustee sale and create time to stabilize and sell or refinance. In short, speed and underwriting flexibility reduce lost-opportunity risk and unlock value that standard lending rules can’t capture.

These advantages rest on equity-first underwriting, which we explain next.

Why Is Property Equity More Important Than Credit Scores?

Hard money lenders view property equity as the primary safety net—current value, ARV, and a credible exit plan determine recovery in downside scenarios. That equity-first stance means a borrower with limited credit but strong unencumbered value can qualify because the lender’s downside is covered by real estate. Exit strategy and reliable comps drive LTV more than FICO, shifting focus to appraisal quality and repair scope. Knowing equity is the core approval metric helps you assemble stronger evidence of value and a defensible exit plan rather than over-prioritizing personal credit repair for deals where collateral dominates.

With fundamentals covered, many borrowers ask how credit problems and foreclosure timelines are handled in practice—answered in the final section.

How Can Common Concerns Like Credit Issues and Foreclosure Bailouts Be Addressed?

Common concerns—low credit, imminent foreclosure, and unconventional property eligibility—are addressed through alternative underwriting that prioritizes equity, a documented exit plan, and fast execution. Equity-first loans accept compensating factors like strong ARV, verified contractor bids, and proof of funds. DSCR and P&L pathways underwrite based on income or property cash flow when tax returns or personal income statements are limited. Foreclosure bailouts compress timelines by focusing on title and payoff mechanics rather than lengthy income verification—speed and clear payoff figures are the critical elements. The subsections below give practical steps and a checklist to present when urgency matters.

Can Borrowers with Low Credit Scores Still Qualify for Hard Money Loans?

Yes. Low-credit borrowers can qualify when the loan is secured primarily by property equity and when the exit plan shows a reliable repayment path—such as a pending resale or a refinance after rehab. Lenders look for compensating documentation: a recent appraisal or solid comps, detailed repair estimates, and verifiable funds or contractor timelines. Strengthen your application with a conservative budget, realistic timeline, and any past performance evidence. A clean title and fast responsiveness during underwriting also improve approval odds and shorten time to close.

Those pathways lead directly to urgent bailout programs and how to submit a fast request.

What Solutions Does Fidelity Funding Provide for Foreclosure and Property Eligibility?

Fidelity Funding offers foreclosure bailouts and bridge-style options that prioritize rapid decisions and equity-first underwriting for urgent timelines, with typical funding speeds of 5–7 days on qualifying submissions. The firm’s private lending approach supports loans from $50,000 to $50,000,000, selective high-LTV programs (up to 80–90% on certain deals), in-house underwriting to cut external delays, and no prepayment penalties to preserve borrower exit flexibility. For foreclosure scenarios, submit concise payoff figures, proof of equity (comps or appraisal), title summaries, and a clear bailout exit plan to move quickly from inquiry to conditional approval. Prepare the document checklist and contact the lender’s team or submit a deal through the application pathway for urgent review.

This completes the practical guidance you need to evaluate hard money options, prepare fast submissions, and choose a lender whose operations match your timeline and deal profile.

Frequently Asked Questions

What are the typical interest rates for hard money loans in California?

Rates vary by lender, borrower profile, and loan specifics. Generally, expect higher rates than conventional mortgages—commonly in the 8% to 15% range. Rate drivers include LTV, property condition, and how quickly you need funding. Compare multiple offers and total costs to pick the best fit for your strategy.

How quickly can I expect to receive funding from a hard money lender?

Hard money funding is typically much faster than conventional lending. Most lenders can close in 5 to 14 days depending on deal complexity and completeness of documentation. Some lenders, including Fidelity Funding on qualifying submissions, often fund in 5–7 days. To speed the process, have your documents ready and respond promptly to lender requests.

Are there any prepayment penalties associated with hard money loans?

Prepayment penalties vary by lender and loan terms. Some lenders charge them; others do not. Fidelity Funding states it does not assess prepayment penalties on its programs. Always confirm prepayment language in the term sheet before signing.

What types of properties are eligible for hard money loans?

Hard money can finance residential, commercial, and industrial properties—especially those that don’t meet conventional underwriting because of condition, title issues, or borrower credit. Lenders evaluate eligibility by looking primarily at equity and potential after-repair value (ARV).

Can I use a hard money loan for investment properties?

Yes. Hard money is commonly used for investment properties—acquisitions, renovations, flips, and bridge financing—because it leverages property equity rather than relying solely on personal credit. It’s a practical tool when speed and flexibility matter.

What should I prepare before applying for a hard money loan?

Prepare a deal package that includes a clear exit strategy, appraisal or comparable sales, detailed repair estimates, proof of funds, and a clean title if possible. A well-organized packet and prompt responses during underwriting reduce time to close and improve approval odds.

How does the approval process for hard money loans work?

The process typically includes initial application (24–72 hours), underwriting review (1–5 days), conditional approval and document prep (2–7 days), and closing/funding (1–3 days). Lenders with in-house underwriting can shorten this timeline significantly.

Conclusion

Picking the right hard money lender in California can give your investment strategy the speed and flexibility it needs. This guide has given you the essentials—how hard money works, which programs fit common scenarios, the documents and timelines to expect, and objective checks for choosing a lender. When you’re ready, reach out to a reputable private lender like Fidelity Funding for a tailored review of your deal and next steps. Explore your options and move on the opportunities that matter.