Financing Land Purchases

How to Finance Land Purchases: Fast, Flexible Land Loan Solutions for Investors

Buying land moves quickly, and the right financing lets investors act when opportunity appears. This guide breaks down land loans — how lenders underwrite raw and improved parcels, which short-term and bridge strategies investors use to buy, hold, or develop land, and when an equity-first approach is smarter than a conventional mortgage. You’ll find practical details: expected loan-to-value (LTV) ranges, typical terms and rates, approval and closing timelines, and the documents that speed underwriting. We walk through program options, real investor scenarios, required paperwork, and common questions, with clear examples showing how investor-focused, hard-money solutions differ from traditional mortgages. By the end you’ll have a short checklist to prepare a submission and know when a faster, equity-based loan is the right fit for land acquisition.

What Are Land Loans and How Do They Work for Investors?

Land loans are mortgage-style loans secured by a parcel of land rather than an improved home. Lenders usually underwrite these loans based on property equity and a clear exit strategy instead of relying primarily on borrower income documentation. That means lenders focus on the parcel’s marketability — access, utilities, zoning, and the borrower’s plan to develop, flip, or hold — and set LTV and conditions accordingly. For investors, land loans offer speed and leverage for time-sensitive purchases, but they often come as shorter, interest-only terms that match project timelines. Knowing how lenders treat raw versus improved sites explains availability and pricing.

What Types of Land Can You Finance?

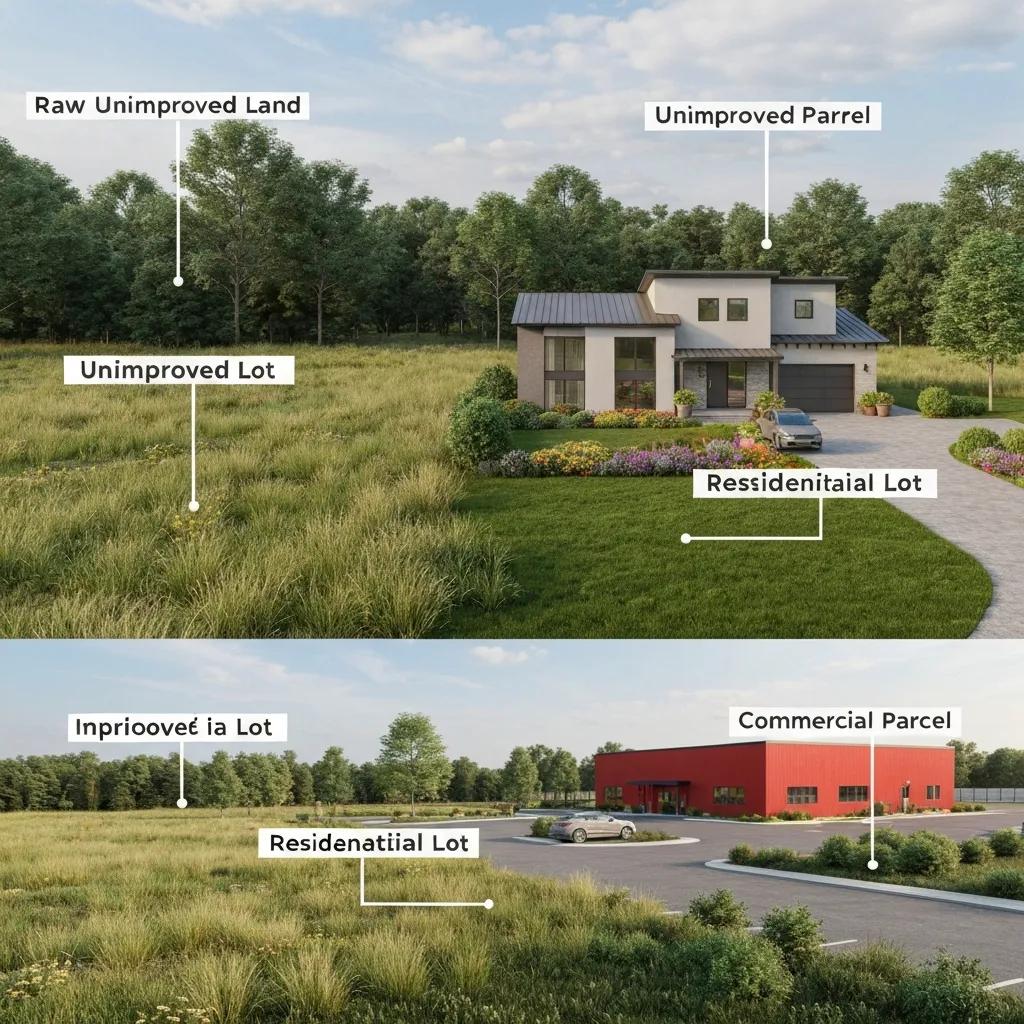

Lenders categorize land to measure risk and set financing options: raw land, unimproved parcels with limited access, improved lots with utilities, residential lots, and commercial parcels each carry different underwriting priorities. Underwriters evaluate access/road, utilities, entitlements, and zoning as key property attributes that determine value and marketability. Raw land without utilities usually requires a bigger equity cushion and may trigger environmental or geotechnical reviews. Typical LTV patterns follow that risk: raw and unimproved parcels usually allow lower LTVs, while improved lots with entitlements can support higher leverage. Investors who prepare clear documentation on property attributes and an exit plan increase lender confidence and approval odds.

- Common land types that affect financing:

Raw land: undeveloped — generally lower LTV because utilities and access are limited.Unimproved lot: may have road access but lacks full utilities; needs extra scrutiny.Improved lot: utilities and road access are present, enabling stronger leverage.Commercial parcel: zoned for business use; underwriting weighs income potential.

Understanding these categories helps you shape offers and exit plans that align with lender expectations.

How Do Land Loans Differ from Traditional Mortgages?

Land loans differ from conventional mortgages in three main ways: underwriting focus, timeline, and documentation. Conventional mortgages prioritize borrower income, credit, tax returns, and long amortizing schedules. Many land and hard-money loans prioritize property equity, exit strategy, and speed, often using interest-only payments for short terms. The trade-offs are clear: faster approvals and leverage tailored to project risk, but higher rates and shorter amortizations. Knowing these differences helps investors pick the right financing when banks are too slow or require too much documentation for time-sensitive deals, and it clarifies when hard-money land loans are the better choice.

- Key distinctions between land loans and mortgages:

Underwriting focus: property equity and attributes versus borrower income and credit.

Timeline: land loans can be approved and closed faster.

Structure: short-term, interest-only options vs. long-term amortizing mortgages.

What Land Loan Programs Does Fidelity Funding Offer?

Fidelity Funding offers a range of investor-focused loan programs built for fast execution: purchase / hard-money loans, land & construction combos, fix-and-flip structures, bridge and bailout loans, commercial financing, DSCR solutions, and P&L-based approvals for business-purpose borrowers. These programs address common investor needs like quick closings, rehab funding, and limited income documentation. Below is a compact comparison showing representative program terms, rates, LTVs, and approval speed so you can spot the right product for your deal.

Fidelity Funding program comparison for quick scanning:

| Loan Program | Typical Term | Typical Rate | Typical LTV | Speed to Approval |

|---|---|---|---|---|

| Purchase / Hard Money | 12–60 months | Starting 6.99% (IO) | Up to 70% (75% case-by-case) | Approvals often in 24–48 hours |

| Land & Construction | 12–60 months | Starting 6.99% (IO) | Case-specific (equity-based) | Fast if entitlements clear |

| Fix & Flip / Rehab | 12–24 months | Starting 6.99% (IO) | ARV up to 85–90% incl. rehab | Closings often 5–7 days |

| Bridge / Bailout | Short-term | Starting 6.99% (IO) | Equity-based | Very fast for time-sensitive deals |

That table highlights how program choice balances term length, interest structure, leverage, and speed. The section that follows explains why hard-money mechanics enable rapid funding.

How Do Hard Money Land Loans Provide Fast Financing?

Hard-money land loans move quickly because underwriters prioritize collateral equity and a clear exit plan over extensive income verification. The typical operational flow is: inquiry → initial qualification → property and title review → appraisal/survey → underwriting decision → closing. Approvals can be reached in 24–48 hours and full closings in 5–7 days when gating items are resolved. Factors that speed everything up include clean title, recent comps or appraisals, and a defined exit — sale, development loan, or refinance. Knowing these steps helps you submit a complete package and avoid common delays.

- Factors that speed approval:

Clear title and minimal encumbrances.Recent appraisal or market comps.A defined exit strategy and evidence of equity.

Below is a short operational checklist of the documents lenders commonly request.

What Are the Terms, Rates, and Loan-to-Value Ratios for Land Loans?

Investor-focused land financing reflects higher risk and shorter horizons: rates typically start around 6.99% on interest-only loans, with terms commonly ranging from 12 to 60 months to match development or resale schedules. Typical LTVs can reach up to 70% (with occasional approvals to 75% on a case-by-case basis). For renovation-driven deals, ARV-based financing can allow up to 85–90% including rehab funds. Fees, points, and interest-only payments are common, and lenders often use holdbacks or construction draws for site improvements. These numbers help you model cash flows and decide whether the financing aligns with your expected returns.

| Metric | What It Means | Typical Value |

|---|---|---|

| Interest rate | Starting point for interest-only loans | Starting 6.99% (interest-only) |

| Term length | Duration of the loan | 12–60 months |

| Loan-to-value (LTV) | Leverage vs. property value | Up to 70% (75% case-by-case) |

| ARV / Rehab funding | For fix/develop deals | ARV up to 85–90% + rehab funds |

Use these metrics to shape offers and exit strategies. Next, we map common investor scenarios to the right loan structures.

How Can Investors Use Land Loans for Different Investment Scenarios?

Investors tap land loans for many strategies: quick acquisition of raw parcels to flip, bridge financing for foreclosures or off-market buys, purchase-plus-construction stacks for lot development, and bailouts or second-position loans to protect equity. The right product depends on exit timing, scope of work, and parcel condition — raw land usually needs more upfront equity and a stronger exit plan, while improved lots can unlock higher LTVs and construction combos. The table below connects typical scenarios to recommended loan types, LTV ranges, and realistic timelines so you can plan financing alongside execution.

| Investment Scenario | Best Loan Type | Typical LTV | Timeline |

|---|---|---|---|

| Raw land buy-and-hold | Short-term hard money or bridge | Lower LTV (conservative) | 30–90 days closing; hold per plan |

| Lot development | Land + construction combo | Mid-to-high if entitlements exist | 60–180 days construction phases |

| Fix-and-flip land | Purchase + rehab financing | ARV-based up to 85–90% | 30–120 day rehab cycle |

| Foreclosure bailout | Bridge / bailout loan | Equity-based, case-specific | Immediate approval/closing preferred |

These mappings show how financing structure aligns with timelines and exit strategies. The sections below explain underwriting for raw parcels and how rehab or bridge funds are managed.

How Does Financing Work for Raw and Vacant Land Investments?

Financing raw or vacant land means lenders will scrutinize zoning, access, utilities, environmental risk, and realistic resale or development timelines. Underwriting leans heavily on demonstrated equity and a credible exit. Raw land often triggers extra third-party reports — environmental, geotechnical, or boundary surveys — which can become gating items. Present a clear plan (entitlement timeline, development costs, or resale comps) and expect lower LTVs or contingency holdbacks until entitlements or improvements reduce risk. Preparing these items upfront shortens underwriting and increases the chance of a fast approval.

What Are Bridge Loans and Fix and Flip Land Financing Options?

Bridge loans and fix-and-flip structures for land combine short-term purchase financing with rehab or site-improvement funds, commonly structured as an interest-only acquisition tranche plus controlled draws for construction. For flip-style land deals, lenders often use ARV to determine total leverage when improvements are part of the exit; construction holdbacks and staged disbursements protect lender capital while allowing progress. Bridge loans supply quick liquidity for time-sensitive purchases or bailout situations, and they’re designed with short maturities and fast funding to match those needs.

- Typical structures used:

Acquisition loan (interest-only) + construction holdback.

Single-close land + construction financing with staged draws.

Short-term bridge with fast approval for foreclosure rescue.

Knowing these structures helps you select the best approach for time-sensitive deals and development projects.

What Are the Benefits of Choosing Fidelity Funding for Land Financing?

Working with an equity-focused hard-money partner delivers the speed and flexibility active investors need: approvals commonly in 24–48 hours, closings often in 5–7 days, and underwriting that emphasizes collateral value over exhaustive credit or tax documentation. Fidelity Funding supports residential, multifamily, commercial, and land borrowers with loan options like land + construction, fix-and-flip financing, and DSCR or P&L-based approvals for business-purpose deals. That orientation reduces friction for borrowers who need quick execution and a clear exit strategy, while offering structured terms such as interest-only payments and 12–60 month loan durations. For many investors, fast decisioning and equity-led underwriting make the difference in winning time-sensitive opportunities.

- Key investor benefits include:

Speed: approvals tied to property equity rather than lengthy income verification.Program flexibility: options for land, construction, and bridge uses.Clear metrics: leverage and rehab funding guidelines that help model deal returns.

If you’re ready to submit a deal or discuss options, Fidelity Funding is based in Glendale, California. Call (877) 300-3007 to start a conversation about program fit and timing.

How Does Equity-Based Lending Help Investors with Credit Concerns?

Equity-based lending shifts the spotlight from borrower FICO and tax returns to the value and liquidity of the collateral. That lets investors with imperfect credit or recent bankruptcies access capital when the deal shows sufficient equity and a viable exit. In practice, lenders will ask for proof of collateral value and exit plans — recent comps, appraisals, entitlement status, and a realistic timeline — and may require higher down payment or pricing to offset borrower risk. Equity-based approval expands eligibility, but title issues, fraud indicators, or materially defective collateral can still block funding. Clear equity evidence and a believable exit accelerate approvals.

Why Is Speed and Flexibility Critical for Land Investors?

Speed and flexible loan structures matter because acquisition windows are often short and carrying costs for undeveloped parcels can quickly erode returns. Fast approvals let investors submit stronger offers and win off-market or foreclosure-related opportunities that conventional lenders can’t close in time. Flexible terms — interest-only payments, short maturities, and staged construction draws — lower holding costs and align financing with project timelines, improving net returns and enabling phased development strategies. Understanding how speed and structure affect deal economics helps you coordinate offers, due diligence, and exits effectively.

- Examples of time-sensitive value:

Competitive bidding where a fast close beats conditional offers.

Foreclosure bailouts where immediate funds protect equity.

Rapid site improvements enabled by staged construction draws.

These advantages explain why many active investors prefer equity-based, fast-closing lenders for land work. The next section covers the practical steps to get approved quickly.

What Are the Key Requirements and Steps to Get a Land Loan?

Lenders evaluate four core elements: collateral quality (title, access, utilities), exit strategy (sale, refinance, development), borrower capacity (proof of funds for down payment or draws), and third-party reports (appraisal, survey, environmental if needed). A streamlined approval roadmap looks like this: initial inquiry with basic property and borrower facts, submit a complete document packet, rapid title and appraisal orders, underwriting decision, then closing once gating items clear. Preparing clear title, recent comps, proof of funds, and a concise exit plan in advance meaningfully improves the chance of approvals within 24–48 hours and closings in 5–7 days. The table below maps typical requirements to providers and why each item matters.

| Requirement | Who Provides | Typical Detail |

|---|---|---|

| Proof of funds | Borrower / Seller | Bank statements or escrow statements showing down payment or reserves |

| Title report | Title company | Demonstrates clear ownership and encumbrances |

| Appraisal / comps | Appraiser / Broker | Establishes market value and ARV where applicable |

| Surveys / enviro reports | Third-party vendors | Required for raw/unimproved parcels to assess risk |

Pulling these items together before submission avoids common delays. Follow these actionable submission steps:

- Prepare a concise submission packet with the property address, purchase terms, photos, comps, and a clear exit plan.

- Include proof of funds and any business P&L if applying under business-purpose approvals.

- Clear title issues or disclose liens up front and note proposed remedies.

- Communicate your target timeline and any conditional matters (entitlements, permits) to the lender.

Following these steps shortens underwriting cycles and improves predictability. The final section explains what to expect during rapid approvals.

What Documents and Property Details Are Needed for Approval?

Lenders typically request a set of borrower, property, and transaction documents that demonstrate collateral quality and exit feasibility: title reports, purchase agreements, proof of funds, recent appraisals or broker price opinions, site surveys, environmental or geotechnical studies for higher-risk parcels, and business P&L or DSCR data when relevant. Each item serves a specific underwriting need: title confirms ownership and encumbrances, appraisal sets value and ARV, and environmental or geotech reports uncover latent risk — especially on raw land. Providing well-organized copies at submission prevents back-and-forth and supports expedited approvals.

How Can Investors Apply and Get Approved Quickly?

Speed up approvals by submitting a complete packet, being transparent about title or zoning issues, and presenting a concise exit strategy supported by credible comps or development budgets. Clear timelines and contingencies let the lender prioritize title and appraisal orders; many fast lenders begin underwriting as soon as key items arrive, enabling approvals in 24–48 hours and closings in roughly 5–7 days when no major gating items exist. For immediate discussions about program fit and timing, call Fidelity Funding at (877) 300-3007 to review documentation expectations and next steps.

What Common Questions Do Investors Have About Financing Land Purchases?

Investors often ask whether poor credit blocks land financing, how terms vary by land type, and what timelines to expect. Straight answers help borrowers choose the right path. Equity-based underwriting can enable loans despite imperfect credit when the collateral and exit are strong, though lenders still review title, fraud indicators, and the plausibility of the exit plan. Terms shift with land quality — raw parcels usually carry shorter terms and lower LTVs, while improved lots and ARV-based projects can access higher leverage — and fast lenders emphasize timelines that match your exit strategy. The short Q&A below addresses the questions we hear most.

Can I Get a Land Loan with Bad Credit or Bankruptcy?

Yes — equity-first lenders often approve borrowers with lower credit scores or recent bankruptcies if the property equity and exit plan sufficiently mitigate risk. Approvals are deal-specific: lenders may ask for larger down payments, higher pricing, or extra documentation to offset borrower risk. Demonstrating significant equity, recent comps, a realistic resale or development plan, and clean title is critical. Credit issues won’t automatically disqualify you, but they will affect the lender’s conditions and pricing.

How Do Loan Terms Vary by Land Type and Investment Purpose?

Terms change with parcel condition and intended use. Raw land usually triggers shorter maturities, lower LTVs, and extra report requirements. Improved residential lots or commercial parcels with income potential can qualify for longer terms and higher leverage. For fix-and-flip or development projects, lenders often use ARV plus construction budgets to set combined financing up to ARV thresholds, enabling greater effective leverage when the exit supports it. Match term length and structure to your exit — resale, refinance, or construction completion — to reduce costs and align expectations.

- Common term variations:

Raw land: lower LTV, short-term interest-only financing.

Improved lot: higher LTV when utilities and entitlements exist.

Development/Construction: staged draws and terms that match the build schedule.

These guidelines clarify typical lender behavior and help you design deals that fit your risk-return profile.

Frequently Asked Questions

What is the typical approval timeline for land loans?

Timelines vary by deal complexity and lender. Many equity-focused lenders, including Fidelity Funding, can approve in 24–48 hours. Once approved, closings often happen within 5–7 days, so preparing your documentation in advance is essential to avoid delays.

Are there specific documents required for raw land financing?

Yes. Raw land usually requires title reports, recent appraisals, environmental assessments, and surveys to assess zoning and access. A clear exit strategy — development plans or resale comps — is also important. Supplying these documents up front streamlines underwriting and improves the chance of quick approval.

How can I improve my chances of getting a land loan?

Submit a thorough submission packet with proof of funds, title reports, and a clear exit plan. Demonstrate meaningful property equity and a realistic development or resale plan. Address potential title issues up front and communicate your timeline and contingencies so lenders can prioritize your file for faster decisions.

What factors influence the interest rates for land loans?

Rates depend on land type, LTV, and the borrower’s risk profile. Raw or unimproved land typically carries higher rates due to greater uncertainty, while improved lots with utilities may receive lower pricing. The strength of the exit strategy and prevailing market conditions also affect rates. Compare lenders to find the best terms for your situation.

Can I use a land loan for investment properties?

Yes. Land loans are commonly used for investment-grade purchases — raw or improved parcels intended for development or resale. Different loan structures apply depending on whether you plan to build residential or commercial properties. Lenders will evaluate expected returns and exit feasibility when considering these loans.

What are the risks associated with financing raw land?

Raw land carries risks like zoning restrictions, limited access to utilities, and environmental issues that may require costly assessments. Lenders typically demand a larger equity cushion, which lowers LTV. The resale market for raw land can be less predictable, so a solid exit strategy and thorough due diligence are essential before buying.

What should I consider when choosing a lender for land financing?

Consider the lender’s experience with land loans, approval timelines, and program flexibility. Look for lenders that use equity-based underwriting if you need speed or have limited documentation. Compare terms, LTV limits, rates, and fees. A lender that understands land financing and offers tailored solutions will help you close more deals.

Conclusion

Knowing how land financing works gives investors the confidence to act quickly and structure deals that fit project timelines. Fast, flexible, equity-focused loans let you compete in tight markets while managing risks conventional mortgages can’t address. If you’d like to review a submission or discuss options, explore Fidelity Funding’s tailored solutions or call us to talk through your project and timing.