Step-by-Step Qualifications to Secure a Private Money Loan in California

Private money loans in California are short-term, asset-backed loans that lean on property equity instead of conventional credit boxes. This guide walks investors and property owners through clear, step-by-step qualifications, typical timelines, and the documents you should assemble to get fast funding for purchases, refinances, rehab projects, and emergency bailouts. You’ll learn the core underwriting drivers—equity, exit plan, borrower capacity, and property condition—followed by program-specific checklists for purchase loans, fix-and-flips, seconds, commercial deals, DSCR loans, and P&L-based approvals. Practical details cover typical terms, interest and fee ranges, closing timelines, and prioritized document lists that speed approval. Short examples show how metrics like loan-to-value (LTV) and after-repair value (ARV) translate into maximum loan size and required down payment. Finally, we summarize how an equity-first private lender supports investors, outline submission steps, and explain what happens from initial approval through funding.

What Are the Core Qualifications for Private Money Loans in California?

Private money underwriting in California is asset-first: lenders focus on the property’s collateral value, a credible exit route, and the borrower’s ability to repay rather than rigid FICO thresholds. Underwriters check current equity and marketability, confirm a realistic exit strategy (sale, refinance, or construction payoff), and review liquidity or project cash flow to ensure repayment. Property condition and local comps influence valuation risk, while borrower experience and documentation lower execution risk. Those inputs are then reflected in an LTV cap and pricing that match the deal’s combined risk.

- Enough property equity to support the requested loan amount and a credible exit that repays it.

- A documented exit strategy with timelines and realistic market comparables.

- Proof of repayment capacity — recent bank statements, project budgets, or P&L where applicable.

- Acceptable property condition and clean title to secure collateral enforcement.

Fidelity Funding | Hard Money Loans follows an equity-first underwriting model that accelerates decisions by putting measurable collateral at the center of risk analysis; see the “Why Choose Fidelity Funding for Your Private Money Loan in California?” section for details.

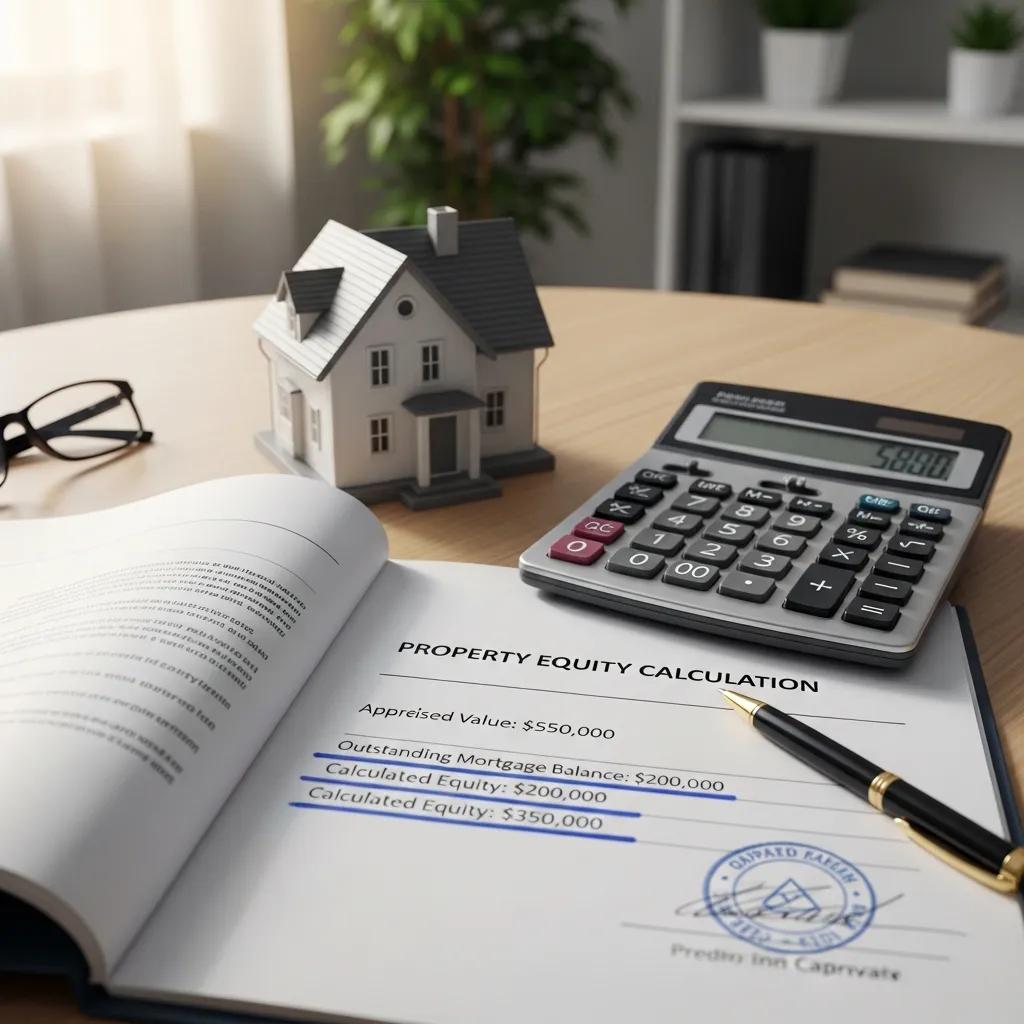

How Does Property Equity Influence Loan Approval?

Equity is the single most important collateral metric: equity = property value minus existing liens, and lenders measure exposure as loan-to-value (LTV). More equity reduces potential loss severity and usually raises the allowable LTV, which increases the maximum loan an investor can get. For example, a property with an as‑is value of $400,000 and a first mortgage of $160,000 leaves $240,000 in equity; a lender willing to lend up to 70% LTV against value might structure a new loan around $280,000 total, though combined-liens and payoffs will change the final number. In short, strong equity can offset limited credit history or a short track record because it improves the lender’s recovery position.

Lenders determine LTV using recent appraisals or broker price opinions and, for rehab deals, rely on ARV. Knowing these calculations up front helps borrowers request realistic loan amounts and speeds underwriting.

What Role Does Real Estate Investor Experience Play?

Experience lowers execution risk. Seasoned investors with verifiable track records, completed project references, and solid contractor relationships typically receive better terms. Underwriters review past flips, adherence to timelines, and profit margins as proof of capability. First-time investors can still qualify but may need larger equity cushions, a co-borrower with experience, higher fees, or more conservative LTVs. Clear documentation—project portfolios, contractor bids, and references—shortens review by showing you understand scope, schedule, and cost control.

If you’re newer to investing, lean into detailed project plans and conservative budgets to bridge the experience gap and show a viable exit.

How Do You Qualify for Specific Private Money Loan Programs in California?

Qualification standards vary by program because each product carries different risks—purchase loans, rehab financing, bailouts, seconds, commercial loans, DSCR loans, and P&L-based approvals all look for focused documentation and measurable metrics. Examples: LTV for purchases, ARV and draw schedules for rehabs, payoff clarity for bailouts, CLTV for seconds, income and lease documentation for commercial and DSCR loans, and verified P&Ls for business borrowers. Below are concise, program-specific checklists to help you match your deal to the right product.

What Are the Purchase Loan Qualifications in California?

Purchase loans center on clear title, proof of funds for closing, and an acceptable LTV given the property type. Lenders typically ask for the purchase contract, an appraisal or valuation, and verification of the down payment or earnest money. Underwriting confirms cash-to-close, any existing liens, and market comps that support the purchase price. When documents are complete and title is clear, approval timelines can be compressed.

Typical lender expectations / Example terms: illustrative ranges frequently seen include LTVs up to 70–80% depending on property and borrower profile, interest rates roughly 8.5%–12%, origination points 1%–3%, conditional approvals in about 48 hours, and funding possible in 5–7 business days for clean deals.

How to Qualify for Fix and Flip Loans in California?

Fix-and-flip loans are underwritten to ARV and hinge on renovation scope and contractor credibility. Borrowers should submit a detailed scope of work, contractor bids, a line-item budget, and a timeline. Lenders require a draw schedule tied to inspections and proof of contractor licensing where applicable. Projected profit margin and the borrower’s flip experience inform maximum loan size and pricing.

Typical lender expectations / Example terms: lenders commonly fund to 60–75% of ARV, require a clear rehab budget and contractor details, price loans in the 8.5%–12% range with 1%–3% points, and disburse funds via draws aligned with completed milestones.

What Are the Requirements for Foreclosure Bailout Loans?

Foreclosure bailouts are time-sensitive and rely on rapid valuation, accurate payoff calculations, and proof of an imminent sale or trustee action. Borrowers should provide notice documents, trustee sale dates, current mortgage statements, and a concise payoff plan showing how the bailout loan will stop the sale. Speed and a clear title path are critical—lenders favor transactions they can close quickly and where equity supports the requested payoff.

Typical lender expectations / Example terms: feasibility hinges on available equity and payoff complexity; rates tend to sit at the higher end of private ranges, approvals can occur in about 48 hours, and funding may complete in 5–7 business days for straightforward payoffs.

How Do Second Mortgage Loan Qualifications Work in California?

Second mortgages use combined loan-to-value (CLTV) calculations that include the first lien plus the proposed second lien; underwriters review payoff statements and title to confirm lien positions. Borrowers should supply current mortgage statements, payoff demands, and a clear reason for the second (cash-out, rehab supplement). CLTV caps commonly limit combined exposure to preserve recovery buffers.

Typical lender expectations / Example terms: CLTV maximums commonly range from 70%–80% depending on first lien terms; documentation must include payoff figures, and pricing reflects second-position risk with higher rates and points versus first-position loans.

What Are the Commercial Loan Qualification Criteria?

Commercial lending focuses on income stability, property cash flow, and deeper collateral underwriting. Lenders look for rent rolls, leases, operating statements, and evidence of competent property management. Smaller commercial loans often require personal guarantees and business financials. Loan sizing depends on property type, income, and market comparables rather than single-family benchmarks.

Typical lender expectations / Example terms: commercial LTVs are often lower than residential (commonly 60%–75%), underwriting weighs net operating income and cap rates, and interest rates and fees vary based on property-specific risk.

What Are the DSCR Loan Requirements in California?

DSCR loans require verifiable rental income so lenders can calculate DSCR = NOI / Debt Service. Lenders generally seek DSCR thresholds (often at or above 1.0–1.25), though flexibility exists if the borrower brings more equity. Acceptable documentation includes leases, rent rolls, and recent operating statements; market rents may be used if short-term vacancies exist.

Typical lender expectations / Example terms: lenders target a minimum DSCR, require lease evidence or rent rolls, and will reduce loan size or increase pricing if DSCR is below target unless offset by additional equity.

How Does P&L Based Loan Approval Work?

P&L-based approvals verify business revenue and expenses to assess repayment capacity for loans tied to business owners or income-producing properties. Lenders accept CPA-prepared or owner-reconciled P&Ls with supporting bank statements and may request a CPA verification letter. Underwriting focuses on sustained net income, seasonality, and consistency between deposits and reported revenue.

Typical lender expectations / Example terms: acceptable formats include CPA-prepared statements or reconciled owner P&Ls supported by bank records; lenders may ask for additional reserves or higher equity when relying on P&L instead of tax returns.

Intro to the comparison table: The table below summarizes core qualification metrics across these programs so you can compare them quickly.

| Loan Program | Key Qualification | Typical Value / Example |

|---|---|---|

| Purchase Loan | Down payment / LTV | LTV commonly up to 70–80% depending on property type |

| Fix & Flip Loan | ARV and rehab plan | Loan up to 60–75% of ARV with draw schedule |

| Foreclosure Bailout | Payoff clarity & speed | Approval in ~48 hours if equity and title permit |

| Second Mortgage | Combined LTV (CLTV) | CLTV typically capped near 70–80% |

| Commercial Loan | Income & leases | LTV often 60–75% based on NOI and cap rate |

| DSCR Loan | Debt Service Coverage Ratio | DSCR target often 1.0–1.25; income documents required |

| P&L Based Loan | Business profitability | CPA or reconciled P&L plus bank statements required |

What Are the Typical Terms and Conditions of Private Money Loans in California?

Private money loans prioritize short terms, interest-driven payments, and flexible exits that match investor timelines. Typical durations range from short bridge periods (6–12 months) to several years for stabilized commercial financing. Repayment structures commonly use interest-only monthly payments with a balloon at maturity or amortizing schedules for longer terms. Pricing and fees reflect risk factors like LTV, property type, borrower experience, and lien position. Knowing how rates, points, and term length affect monthly carry and exit feasibility is key to picking the right loan.

Below are the core attributes you’ll commonly see and how they influence qualification and cash flow planning.

What Interest Rates and Origination Fees Should Borrowers Expect?

Interest rates for private money loans in California typically fall in a band that reflects borrower risk and deal complexity—roughly 8.5%–12% in many cases, with variation by LTV and property type. Origination fees (points) usually run 1%–3% of the loan and cover underwriting and initial processing. Higher perceived risk—weak DSCR, low equity, or complex title—pushes rates and points up; stronger collateral and experienced borrowers can often negotiate better pricing. Model these costs into your project pro forma so the exit covers all obligations.

How Do Loan Terms and Repayment Structures Affect Qualification?

Shorter-term loans demand a clear, executable exit because principal repayment or refinance must occur within months to a few years. Interest-only payments lower monthly carry and help cash flow during renovation or stabilization, but they defer principal reduction and create a larger balloon at maturity. Longer-term amortizing loans ease exit pressure but usually require stricter income and property underwriting. Lenders often prefer interest-only structures for flips and amortization for stabilized commercial assets; choose the structure that aligns monthly obligations with your exit.

What Closing Costs and Fees Are Common for These Loans?

Closing costs include origination fees, underwriting and processing charges, escrow and title fees, recording fees, and any lender-ordered inspections or valuations. Some fees are negotiable depending on deal size and lender flexibility; third-party costs like title and escrow are customary. Borrowers should budget roughly 2%–4% of the loan amount for upfront closing expenses in addition to origination points, and always request a lender estimate to plan cash-to-close accurately.

Intro to terms table: The table below summarizes typical ranges and how each attribute affects qualification.

| Attribute | Typical Range | Notes / How It Affects Qualification |

|---|---|---|

| Interest Rate | ~8.5%–12% | Higher rates reflect greater risk or higher LTV |

| Origination Points | 1%–3% | Upfront cost; negotiable with stronger profiles |

| Loan Term | 6 months – 5 years | Shorter terms require clear exit strategies |

| Prepayment | Variable | Prepayment penalties can affect refinance planning |

| Closing Costs | 2%–4% of loan | Third-party fees plus lender charges; budget accordingly |

What Documents Are Required to Qualify for a Private Money Loan in California?

A prioritized, organized document package speeds underwriting and cuts back-and-forth. Lenders typically want property documents (title report, mortgage statements, valuation, photos), borrower financials (bank statements, P&L, proof of funds), and project-specific items (scope of work, contractor bids, permits). Present documents in labeled folders and include a concise cover summary with your exit strategy and timeline to shorten approval times. Below are specifics and preparation tips.

Which Financial Statements and Property Documents Are Needed?

Must-have property docs include a current title report or commitment, recent mortgage statements, property photos, and any existing leases for income properties. Financials commonly requested are recent bank statements (typically 3–12 months), P&L statements for business borrowers, and proof of funds for down payment or closing. For rental properties, provide rent rolls, leases, and operating statements. Verified, well-organized documents let lenders perform quick eligibility checks and move files into underwriting faster.

A clearly labeled package that highlights your exit strategy reduces perceived execution risk and helps speed approvals.

How to Prepare a Complete Loan Application Package?

Assemble documents in three sections—property, borrower, and project—and include a one-page summary stating loan purpose, requested amount, exit plan, and timeline. Use common file formats (PDF for documents, JPEG for photos) and label files with the property address and document type. Provide contractor or property manager contact info for quick verification. Ordering a preliminary title report and a basic valuation early can eliminate common delays and signals seriousness in a fast-moving transaction.

Prepare a simple checklist and confirm payoff statements and contractor bids are current to avoid last-minute hold-ups.

Intro to documents table: The table below gives a quick reference for when documents are required and how to prepare them for submission.

| Document Type | When It’s Required | Example / How to Prepare |

|---|---|---|

| Title Report | Always before closing | Order a preliminary report; ensure all liens are disclosed |

| Mortgage/Payoff Statements | For seconds or bailouts | Obtain current payoff figures from the loan servicer |

| Bank Statements | To show reserves/repayment ability | Provide the latest 3–12 months, reconciled if necessary |

| P&L / Tax Returns | For P&L approvals or income verification | Use CPA-prepared or reconciled owner P&Ls with bank support |

| Scope of Work & Contractor Bids | For rehab/flip financing | Include a line-item budget, timeline, and contractor license info |

If you’re ready to submit a deal, assemble the package as described and reach out through the lender’s contact channels. Fidelity Funding accepts deal submissions and answers initial questions by phone; expect a prompt response with guidance on next steps. Include a concise cover summary, attach key docs (title, payoff, scope), and note your preferred timeline—this clarifies urgency and helps the lender prioritize review. Expect an eligibility discussion, followed by valuation, underwriting, and a conditional approval when the file is complete.

What Are Common Borrower Concerns About Private Money Loans in California?

Borrowers often worry about credit requirements, speed of approval and funding, property eligibility, and how California’s foreclosure rules affect bailout options. Private lenders put collateral and exit clarity first, which reduces emphasis on conventional credit scores but increases scrutiny on valuation and title. Complete documentation and a realistic exit plan usually resolve these concerns and speed decisions. Below are concise answers and practical tips for each common issue.

Is a Good Credit Score Required to Qualify?

Credit matters less for private money loans than for traditional mortgages because underwriting is asset-based, but it still affects pricing and borrower credibility. Borrowers with lower scores can qualify if they provide meaningful equity, a strong exit strategy, or third-party guarantees. Typical private-lender practice balances credit with collateral—strong equity can offset weaker credit, while good credit may modestly improve pricing or reduce reserve requirements. Thorough bank statements and solid references reduce friction for borrowers with imperfect credit.

How Fast Can Private Money Loans Be Approved and Funded?

Yes—private money loans can close quickly when documentation and title are clear. Conditional approvals are frequently achievable in about 48 hours for straightforward deals, with funding possible in 5–7 business days when valuation, title, and escrow timelines align. Speed depends on a complete submission, fast title work, and timely third-party reports; foreclosure bailouts may compress timelines further but require immediate delivery of payoff and notice documents. Ordering a title report and preparing contractor/lease verification ahead of time shortens the path to funding.

What Property Types Are Eligible for Private Money Loans?

Private lenders commonly finance a broad set of property types including single-family homes, multi-family buildings, mixed-use assets, small commercial properties, and land (with caveats). Eligibility depends on marketability, condition, and zoning; vacant land or heavily encumbered commercial assets often require stricter underwriting. Lenders also consider property use—owner-occupied purchases differ from investment rehab financing—so be prepared to show current use and zoning compliance.

- Single-family homes

- Multi-family (2–20 units depending on the lender)

- Small retail, office, and mixed-use

- Land and ground-up construction (requires specialized underwriting)

These categories represent typical eligible collateral; each carries specific documentation and valuation requirements that affect underwriting.

How Does California’s Foreclosure Process Affect Loan Qualifications?

California’s mostly non-judicial foreclosure process shortens certain timelines, so lenders and borrowers must move quickly in bailout scenarios. Imminent trustee sale dates create urgency and make rapid valuation, payoff calculations, and title clearance essential. Lenders measure the remaining timeline against required due diligence and prefer deals with clear equity buffers and straightforward lien stacks. Knowing local trustee procedures and having payoff statements and foreclosure notices ready is essential for qualifying for emergency financing.

Why Choose Fidelity Funding for Your Private Money Loan in California?

Fidelity Funding | Hard Money Loans focuses on fast decisions and equity-first underwriting to help investors access capital for time-sensitive opportunities. Based in Glendale, California, we offer a broad product mix—purchases, refinances, fix-and-flips, bridge loans, foreclosure bailouts, construction loans, seconds, DSCR loans, and P&L-based approvals—with typical conditional approvals in about 48 hours and funding as soon as 5–7 days on qualifying deals. Loan sizes scale from single-property transactions to larger commercial financings. Our process prioritizes clear property equity and executable exit plans so you can act with confidence.

The following list summarizes Fidelity Funding’s core differentiators:

- Fast decision-making: conditional approvals often in roughly 48 hours for complete submissions.

- Equity-first underwriting: practical focus on collateral value and exit feasibility.

- Flexible product menu: supports purchases, fix-and-flip, bailouts, seconds, commercial, DSCR, and P&L-based approvals.

This positioning helps borrowers quickly match their deal to the right financing solution with predictable expectations.

How Does Fidelity Funding’s Focus on Property Equity Benefit Borrowers?

An equity-first approach accelerates underwriting because the lender’s primary risk measure—collateral recovery position—is established early, enabling faster conditional approvals when title and valuation are clear. This benefits borrowers who can show sufficient equity even if credit or experience is imperfect. Practically speaking, Fidelity Funding’s illustrative ranges align with industry norms: interest rates often sit in the 8.5%–12% band, origination points commonly 1%–3%, and LTVs may reach 80%–90% on select, well-documented deals. Emphasizing equity and a clear exit strategy increases access to prompt capital for time-sensitive transactions.

What Are the Steps to Submit a Loan Deal or Contact Fidelity Funding?

To submit a deal, prepare a concise package with a one-page cover summary, property address, requested loan amount, exit strategy, and the key documents described earlier (title, payoff, bank statements, scope of work as applicable). Call the Fidelity Funding phone number for an initial eligibility discussion and indicate urgency if the file is time-sensitive; you’ll receive an eligibility response and a next-step checklist. After initial approval, the lender orders valuation and title, completes underwriting, and issues a commitment with clear conditions; funding follows when those conditions are satisfied.

Practical next steps:

- Prepare a one-page deal summary plus key supporting documents.

- Call (877) 300-3007 for an initial eligibility conversation.

- Expect conditional approvals quickly and funding in as little as 5–7 business days for clean, well-documented deals.

These steps walk borrowers through a low-friction submission process centered on transparency, collateral-based decisions, and rapid execution.

Frequently Asked Questions

What is the difference between private money loans and traditional bank loans?

Private money loans differ from traditional bank loans in underwriting focus and speed. Banks emphasize credit scores and income verification; private lenders prioritize collateral value—property equity—which enables quicker approvals (often within 48 hours) and faster funding. Private loans carry higher interest rates and fees because of shorter terms and greater perceived risk compared with conventional mortgages.

Can I use a private money loan for investment properties?

Yes. Private money loans are commonly used for investment properties—single-family homes, multi-family units, and small commercial real estate. They’re especially useful when investors need to buy, renovate, or flip properties quickly. Underwriting centers on property equity and the exit strategy rather than exclusively on credit, making it easier for investors to obtain timely financing.

What are the typical repayment terms for private money loans?

Private money loans usually have short repayment terms from 6 months to 5 years. Many are structured as interest-only with a balloon payment at maturity, which can help cash flow during renovation or stabilization. Borrowers should have a clear exit plan to ensure principal repayment when the loan matures.

Are there any prepayment penalties associated with private money loans?

Prepayment penalties vary by lender. Some charge fees for early payoff; others do not. Review your loan agreement carefully and discuss any potential penalties with the lender before signing so you can plan your refinance or sale without unexpected costs.

How can I improve my chances of getting approved for a private money loan?

Boost approval chances by presenting a complete, well-organized package: show sufficient property equity, a clear exit strategy, and any relevant real-estate experience. Include bank statements, appraisals, and contractor bids. Being transparent, prepared, and responsive helps build lender confidence and speeds underwriting.

What should I expect during the loan approval process?

The process usually follows a predictable path: initial application and eligibility review, valuation and title ordering, underwriting, and a conditional commitment. If your submission is complete, conditional approval can often be issued within 48 hours. Title and appraisal may take additional time; once conditions are met, the lender issues a commitment and moves to funding.

Conclusion

Knowing the qualifications for private money loans in California lets investors secure timely capital based on property equity rather than relying solely on credit scores. Focus on a clear exit strategy and an organized document package to streamline approval and access funding for purchases, refinances, or rehab projects. Whether you’re buying, refinancing, or flipping, understanding these requirements improves your chances of a smooth, fast transaction. Start by preparing your loan package and reaching out to a lender for a quick eligibility check.