Understanding VA Loans

Understanding VA Loans — A Practical Guide for Real Estate Investors and Investment Property Financing

VA loans are mortgage products backed by the Department of Veterans Affairs that let eligible service members, veterans, and certain surviving spouses buy, refinance, or modify homes under borrower-friendly terms. This guide walks through eligibility and obtaining a Certificate of Eligibility (COE), the VA’s occupancy and property rules, and the real-world limits investors face when using VA benefits. Many investors run into timing and occupancy constraints with VA financing — situations where hard money or other alternative lenders become necessary for flips, bailouts, and non-owner-occupied deals. You’ll get a clear view of how VA loans work, the timeline from COE to closing, which properties qualify for house-hacking or multi-unit strategies, and a straightforward comparison between VA loans and hard money options. Practical checklists and comparison tables are included, plus next steps for securing quick capital when VA rules don’t fit your investor timeline.

What is a VA Loan and Who Qualifies?

A VA loan is a government-backed mortgage that reduces lender risk through a VA guaranty, which in turn creates more favorable terms for eligible military-connected borrowers. Because the VA guaranty lowers required down payment and often improves rate pricing, borrowers who meet program rules can see immediate cash-flow advantages. Eligibility hinges on entitlement and a Certificate of Eligibility (COE) that documents service history or survivor status. Confirming who qualifies is the first step in deciding whether a VA loan will work for an owner-occupied purchase or a specific investment plan.

What Are the VA Loan Eligibility Requirements for Veterans and Service Members?

Eligibility depends on service type, length, and discharge characterization and is verified with records like a DD-214 or current active-duty documentation. Typical qualifying paths include minimum active-duty or wartime service periods, sufficient current active-duty service, and specific rules for reservists and National Guard members. In limited cases, surviving spouses may qualify. Lenders and the VA will review discharge status and service dates during underwriting, so having official records ready speeds pre-approval. Clear COE documentation reduces delays and helps move the file smoothly into appraisal and underwriting.

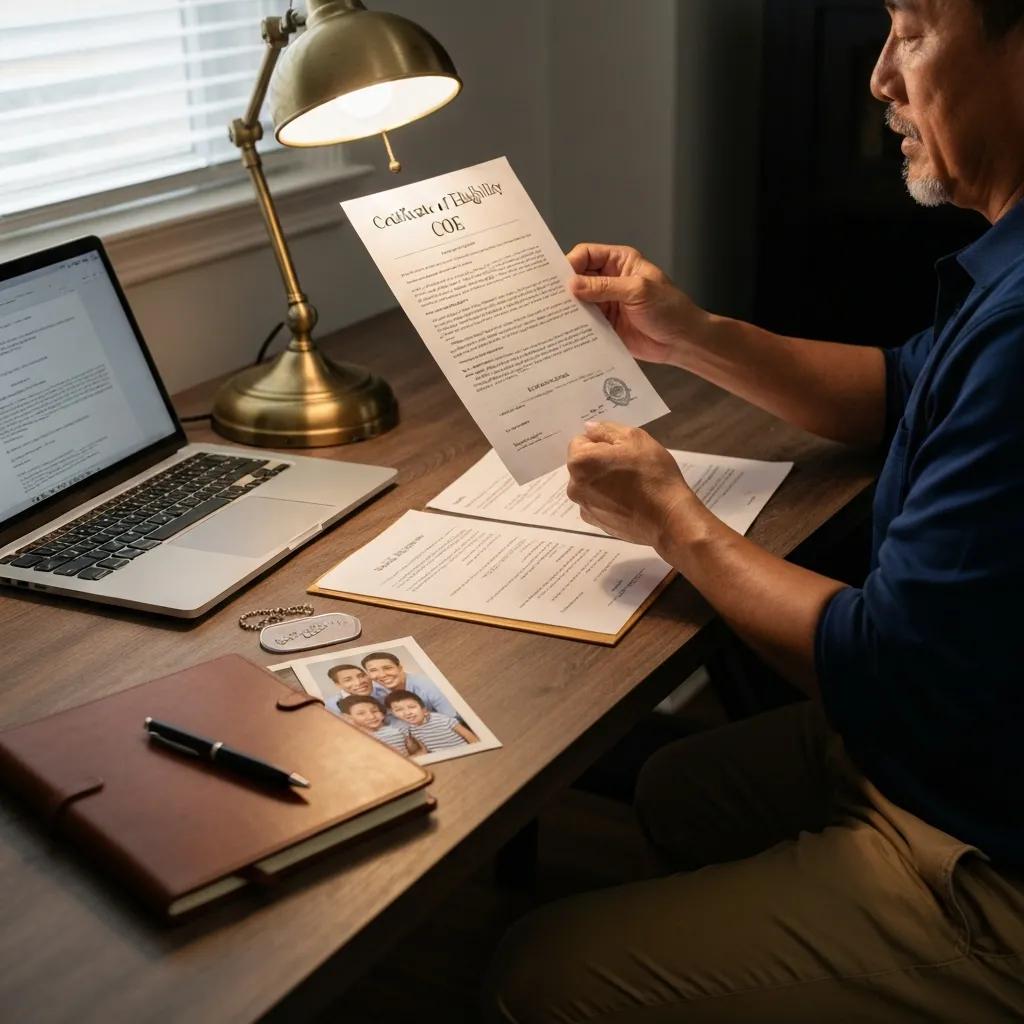

How Do You Obtain a Certificate of Eligibility for a VA Loan?

You can request a Certificate of Eligibility through the VA’s eBenefits portal, ask your lender to pull it on your behalf, or submit it by mail using service records like a DD-214. When a lender handles the request as part of pre-approval, COEs often arrive within a few days; direct requests can take longer if records must be retrieved or corrected. Preparing your service documents, discharge papers, and ID before you apply prevents common delays and helps align COE issuance with the rest of your loan timeline. With a COE in hand, you’ll be ready for rate quotes, underwriting, and appraisal with far less uncertainty.

What Are the Key Benefits of VA Loans for Homebuyers?

VA loans provide several distinct advantages because of the VA guaranty: no required down payment for many eligible borrowers, no private mortgage insurance (PMI), and competitive interest rates that lower monthly payments. These features reduce upfront cash needs and ongoing costs, making homeownership more accessible for qualifying veterans and service members who plan to live in the property. There are also streamlined refinance options through VA refinance programs that can lower payments or simplify an existing loan. For owner-occupant buyers who meet the occupancy and property standards, VA loans often offer the best combination of affordability and flexibility.

What Are the Advantages of No Down Payment and No Private Mortgage Insurance?

Not having to make a down payment cuts the cash required at closing, freeing capital for repairs, reserves, or other investments. Skipping private mortgage insurance keeps monthly housing costs lower compared with conventional loans that require PMI on low down payments until equity builds. For many borrowers — especially those returning from deployment or transitioning careers — these benefits improve affordability and liquidity. It’s important, however, to weigh trade-offs like funding fees and occupancy rules when deciding if VA financing is the right route.

How Do VA Loan Funding Fees and Competitive Interest Rates Affect Borrowers?

Most VA loans include a funding fee that helps sustain the program; the fee varies by loan type and whether you’ve used your entitlement before, and some veteran categories are exempt. Because the VA guaranty lowers lender risk, VA loans often offer competitive interest rates compared with conventional loans, which can reduce long-term financing costs for qualified borrowers. When comparing total cost, factor the funding fee into the loan amount and contrast that with potential down payment and PMI savings to determine the net benefit. Market rates change, so always update comparisons with current lender quotes, but structurally VA loans remain cost-efficient for eligible owner-occupants.

What Are the VA Loan Property Requirements and Occupancy Rules?

VA property eligibility focuses on minimum property standards and an owner-occupancy requirement. The borrower must intend to use the property as a primary residence within a reasonable time after closing. Minimum Property Requirements (MPRs) ensure the home is safe, sanitary, and structurally sound; appraisals and inspections enforce these standards. The occupancy rule presents a practical constraint for investors because VA financing is intended for owner-occupied purchases, limiting its use for pure investment buys. Knowing these property and occupancy constraints is essential when planning strategies such as house hacking, multi-unit purchases, or future conversions to rentals.

What Is the Primary Residence Occupancy Mandate for VA Loans?

The occupancy mandate requires borrowers to certify their intent to occupy the property as a primary residence and generally to move in within about 60 days after closing unless specific exceptions apply. Deployment, temporary work assignments, or other military duties can allow delays, but immediately renting the property without approval or never occupying it can jeopardize the loan. Lenders typically document the occupancy plan at application and may request extra proof if circumstances change. Clear communication and proper documentation protect your VA benefits and reduce the risk of disputes if plans shift after closing.

Can VA Loans Be Used for Multi-Unit Properties and House Hacking Strategies?

Yes — VA loans can finance 2–4 unit properties as long as the borrower occupies one unit as their primary residence. That makes house-hacking an attractive option: you can live in one unit while using rental income from the others to offset mortgage costs. This approach requires careful documentation of occupancy and compliance with MPRs for each unit. House-hacking can be a solid long-term strategy for investors who plan to occupy initially and later convert the property to a rental through refinancing or sale. Pay attention to appraisal details and timelines if you intend to convert owner-occupied units to investment use later on.

When Are VA Loans Not Suitable for Pure Investment Properties?

VA loans aren’t appropriate for pure investment purchases where you don’t intend to live in the property — for example, buy-and-hold rentals, most fix-and-flip projects, and many commercial conversions. Investors who need time-sensitive funding for flips, foreclosure rescues, or non-owner-occupied acquisitions should look at alternatives like hard money loans, DSCR programs, or P&L-based approvals that underwrite to property equity or income instead of occupant status. Those products close faster and use different criteria that better match investor timelines and risk profiles. Spotting when VA rules will block a deal helps you choose the right financing path up front.

How Does the VA Loan Application Process Work and What Are Typical Timelines?

The VA loan process follows a step-by-step flow: verify your COE, get pre-approved, sign a purchase contract, complete the VA appraisal and MPR review, finish underwriting, and close. These steps often add up to a longer closing window than many private or hard money options because appraisal scheduling and VA-specific reviews can add days or weeks. Knowing which tasks typically cause delays — missing documentation, appraisal rework for MPRs, or underwriting backlogs — helps you prepare and set realistic expectations with sellers. The table below breaks down each phase, common documents, and typical timing so you can plan and compare alternatives.

Use this checklist to understand the core steps and likely durations before closing.

- Pre-Approval and COE Confirmation: Gather COE, ID, income statements, and credit info; pre-approval commonly takes a few days.

- Offer and Contract Execution: After you’re under contract, the lender orders the appraisal; this depends on local scheduling and seller timelines.

- Appraisal and Underwriting: The VA appraisal covers MPRs; underwriting resolves conditions before a clear-to-close is issued.

| Application Phase | Typical Documents Required | Typical Timeline |

|---|---|---|

| COE & Pre-Approval | COE, ID, DD-214 or active duty orders, pay stubs | 1–7 days |

| Appraisal & MPRs | Appraisal report, property disclosures, repair estimates | 7–21 days |

| Underwriting to Close | Underwriter conditions, title, homeowner insurance | 7–14 days |

What Are the Steps from Pre-Approval to Closing a VA Loan?

From pre-approval to funding, the process starts with COE verification and ends with title transfer and final funding. Pre-approval confirms creditworthiness and entitlement; once the purchase contract is in place, the lender orders the appraisal and begins title work as underwriting takes over. Underwriters will issue conditions — often requests for extra income documents, clarifications, or appraisal-related repairs — that you must clear before receiving a clear-to-close. Responding quickly to those conditions and anticipating common MPR items shortens the timeline and lowers the chance of seller issues.

What Factors Affect the Speed of VA Loan Funding and Closing?

Key drivers of VA loan speed include appraisal availability, completeness of your COE and supporting documents, lender underwriting capacity, and whether the property requires MPR repairs. Seasonal market activity and regional appraisal backlogs can extend timing, while experienced loan officers and a complete initial submission compress turn times. If you’re an investor needing a tight close, alternative financing that focuses on equity and speed may be a better fit. Anticipating typical delay points — missing service records or appraisal-required fixes — lets you plan contingencies or choose a lender aligned with your timeline.

How Do VA Loans Compare to Hard Money Loans for Real Estate Investors?

VA loans and hard money loans serve different goals. VA loans are government-backed mortgages tailored to eligible owner-occupants, offering favorable pricing but strict occupancy rules and document-heavy underwriting. Hard money loans are private, asset-based financing built for speed and flexible property use. The main differences are occupancy and underwriting focus: VA loans require owner-occupancy and detailed documentation, while hard money lenders underwrite mainly to property equity and your exit plan. For flips, bailouts, or non-owner-occupied purchases, hard money typically provides faster closings and higher short-term leverage despite higher rates and fees. The table below highlights core attributes to help you decide which product fits a particular deal.

| Loan Type | Key Attribute | Typical Value or Characteristic |

|---|---|---|

| VA Loan | LTV / Down Payment | Up to 100% entitlement for eligible borrowers; no down payment for primary residence |

| VA Loan | Speed to Close | Typically 30–45 days, dependent on appraisal and underwriting |

| Hard Money | LTV / Down Payment | Up to 90% for fix-and-flip scenarios; investor equity-driven |

| Hard Money | Speed to Close | Often 5–7 days for experienced lenders on time-sensitive deals |

What Are the Differences in Loan-to-Value, Credit Requirements, and Speed?

VA loans let eligible borrowers finance with minimal or no down payment because of the VA guaranty. Hard money lenders set LTV based on after-repair value (ARV) and project risk, sometimes funding up to 90% for flips. VA underwriting centers on credit, income verification, and COE validation; hard money underwriting centers on collateral value, exit strategy, and investor experience. Speed is a major differentiator: VA loans usually take several weeks due to appraisal and VA-specific review, while hard money can close in as little as 5–7 days on qualifying deals. Those differences define use cases: owner-occupied purchases for VA loans vs. time-sensitive investor transactions for hard money.

Why Are Hard Money Loans a Flexible Alternative for Time-Sensitive Investment Deals?

Hard money loans are equity-first, collateral-driven financing that accept fewer traditional credit or tax-return constraints and can close quickly to meet tight deadlines. That flexibility makes them ideal for fix-and-flip projects, foreclosure rescues, bridge financing, and non-owner-occupied purchases where VA occupancy rules or appraisal timing would block the deal. The trade-off is higher rates and fees, but for many time-sensitive opportunities, the ability to secure a contract and close rapidly outweighs longer-term cost differences. When VA rules create a timing gap, hard money fills it by prioritizing property equity and speed.

If you need a practical hard money alternative, Fidelity Funding offers fast closings, high-LTV financing for flips, and flexible programs that focus on equity rather than full tax-return verification. Based in Glendale, California, Fidelity Funding specializes in residential and commercial hard money loans for investors and business-purpose borrowers. Their investor-focused products are designed to close gaps left by VA occupancy rules and appraisal timing by emphasizing speed and pragmatic underwriting.

How Can Fidelity Funding Support Real Estate Investors with Fast Hard Money Loans?

Fidelity Funding delivers equity-focused hard money programs for purchase, refinance, rehab, bridge, and bailout scenarios so investors can act on time-sensitive opportunities where VA financing may not be practical. The main advantage is speed: experienced hard money lenders like Fidelity Funding often target 5–7 day closings on qualifying deals, relying on property value and a clear exit plan instead of lengthy documentation cycles. Programs include high-LTV options for fix-and-flip work and structured terms for cash-out or bridge financing when immediate capital is required. The table below summarizes representative program attributes to help investors compare options quickly.

| Program | Attribute | Typical Value |

|---|---|---|

| Fix & Flip Loan | Closing Speed | 5–7 days |

| Fix & Flip Loan | Loan Term | 12–18 months |

| Fix & Flip Loan | LTV | Up to 90% (on qualifying projects) |

| Cash-Out / Refinance | LTV | Up to 75% for cash-out situations |

| Bridge / Bailout Loan | Purpose | Foreclosure rescue or time-sensitive payoffs |

What Investor-Focused Loan Programs Does Fidelity Funding Offer?

Fidelity Funding’s product suite covers common investor needs: purchase financing for non-owner-occupied deals, high-LTV fix-and-flip loans, cash-out and refinance options to access equity, short-term bridge loans for foreclosure bailouts, and subordinate seconds/thirds when layered leverage is required. Programs are set up for investors who need quick decisions and funding that reflect property equity rather than full tax-return verification, with terms aligned to project timelines. Interest-only payments and short loan durations help preserve cash flow during renovations and resale. For investors weighing VA loans against hard money, Fidelity Funding is an actionable alternative when VA occupancy or appraisal timing would block a deal.

How Do Speed, Flexibility, and Equity-Based Approvals Benefit Investors?

Speed reduces the risk of losing contracts in competitive markets. By approving based on equity and a clear exit strategy, lenders like Fidelity Funding remove documentation bottlenecks that slow conventional underwriting. Flexible program terms — including acceptance of seconds/thirds in some cases and limited prepayment penalties — let investors structure financing around project economics. A concise document checklist and a predictable 5–7 day closing runway mean investors can pursue foreclosure bailouts, immediate purchase opportunities, and rapid flips with lower execution risk. Preparing core documents and a clear exit plan makes these benefits reliably accessible.

What Are the Next Steps to Secure Financing for Your Investment Property?

Securing the right financing starts with matching the product to the deal—owner-occupied purchase, multi-unit house hack, fix-and-flip, bailout, or long-term rental—and preparing the required documentation. If you’re VA-eligible and will occupy the property, prioritize COE retrieval, pre-approval, and appraisal timing. If you need speed or non-owner-occupied financing, prepare an equity-focused package with property photos, a rehab scope, and a clear exit strategy. The checklist and contact guidance below explain how to submit a deal to a hard money lender and what to expect during review and closing.

- Identify financing purpose and preferred product (VA owner-occupied vs. hard money investor product).

- Gather core documents: proof of entitlement/COE for VA, title report or current mortgage statements, property photos, and rehab scope or P&L where applicable.

- Prepare a written exit strategy with ARV (after-repair value) and an estimated rehab budget or refinance plan.

How Can You Submit a Deal or Contact Fidelity Funding’s Team?

To submit a deal to Fidelity Funding, assemble a concise packet with the property address, purchase contract (if applicable), current mortgage statements or title info, photos, and a short rehab or exit plan to speed review. You can reach Fidelity Funding by phone at (877) 300-3007 or by email at info@fidelityfundingcorp.com for initial inquiries and submission instructions. Include clear project details and desired terms to get the fastest response. Expect a quick initial turnaround for pre-qualification and guidance on any additional documents needed to move toward approval and closing. Focused submissions reduce back-and-forth and help preserve a 5–7 day closing window on qualifying, time-sensitive deals.

What Documents and Information Are Needed to Apply?

Common documents across VA and investor loan paths include proof of ID, COE or service records for VA cases, current mortgage statements or title information, property photos, a rehab scope with cost estimates for rehab loans, and financial statements or P&L documentation when applicable. Program-specific needs vary: fix-and-flip loans typically require a detailed rehab budget and contractor bids; DSCR or P&L-based approvals need rental income worksheets or profit-and-loss statements; bailout loans require foreclosure notices and payoff figures. Organizing these items in advance and presenting a clear exit strategy speeds underwriting and improves the chance of meeting tight closing timelines.

- Core documents: ID, COE (if VA), title or mortgage statements, property photos.

- Investor-specific documents: Rehab scope, contractor estimates, ARV analysis.

- Income/exit documentation: P&L statements, DSCR worksheets, or projected resale plan.

| Submission Item | Purpose | Why It Matters |

|---|---|---|

| COE or Service Records | Verify VA eligibility | Confirms entitlement for VA loan consideration |

| Rehab Scope & Estimates | Support ARV calculations | Demonstrates feasibility for fix-and-flip financing |

| Title / Mortgage Statements | Validate existing liens | Ensures accurate payoff and lien priority for closings |

This guide covered VA loan basics, occupancy rules, timelines, and direct comparisons to hard money alternatives for investors. Use the checklists and tables to pick the financing path that matches your deal. When you need rapid, equity-based funding, contact Fidelity Funding at (877) 300-3007 or info@fidelityfundingcorp.com for help submitting your deal and preparing the documents needed for fast funding.

Frequently Asked Questions

Can I use a VA loan for a second home or vacation property?

No. VA loans are intended for primary residences. Borrowers must occupy the property as their main home within a reasonable time after closing. While VA loans can be used on multi-unit properties, you must live in one of the units. For second homes or vacation properties, you’ll need to pursue other financing options because VA loans do not apply to non-owner-occupied properties.

What happens if I cannot occupy the property after closing?

If you cannot occupy the property as required, the loan may be at risk. The VA requires borrowers to certify intent to occupy the home as their primary residence. If circumstances change — for example, deployment or a job relocation — notify your lender right away to discuss possible exceptions. Not complying with occupancy requirements can lead to penalties or the need to refinance under different terms.

Are there any special considerations for reservists or National Guard members applying for VA loans?

Yes. Reservists and National Guard members can qualify, but their eligibility rules may differ from those for active-duty service members and veterans. They generally must meet specific service thresholds, including minimum active-duty periods. Documentation such as a COE is needed to verify service. Reservists should confirm eligibility and understand any unique aspects of their application.

How does the VA loan funding fee work, and can it be financed?

The VA funding fee is a one-time charge that supports the program. The amount varies based on loan type and prior use of entitlement, and some veterans are exempt. You can usually finance the funding fee into the loan amount rather than paying it out of pocket at closing. Knowing how this fee changes your loan balance and payments is important for budgeting.

What are the implications of using a VA loan for house hacking?

Using a VA loan to house hack can be an effective strategy: you finance a multi-unit property and live in one unit while renting the others to offset mortgage costs. You must still meet VA occupancy rules and document your intent to occupy. Proper paperwork and compliance with VA guidelines keep the loan valid and let you benefit from both owner-occupant terms and rental income.

Can I refinance a VA loan, and what are the benefits?

Yes. The VA Interest Rate Reduction Refinance Loan (IRRRL) lets you refinance to lower your rate with minimal documentation. Benefits include reduced monthly payments and the ability to move from an adjustable-rate mortgage to a fixed rate. Refinancing can also help you access equity for improvements or other needs, making it a useful option for existing VA borrowers.

What should I do if my VA loan application is denied?

If your application is denied, get a clear explanation from your lender and identify the reasons — common issues include limited credit history, insufficient income, or missing documentation. Address the items the lender cites, and consider speaking with a VA loan specialist or financial advisor to improve your chances on a future application.

Conclusion

Knowing how VA loans work gives veterans and service members options to secure affordable home financing and pursue owner-occupied investment strategies. The benefits — like no down payment and competitive rates — make VA loans compelling for eligible borrowers. For investor scenarios that require speed and flexibility, hard money and other alternative lenders can provide timely solutions. When you’re ready to explore options, contact Fidelity Funding for tailored guidance and fast funding alternatives.